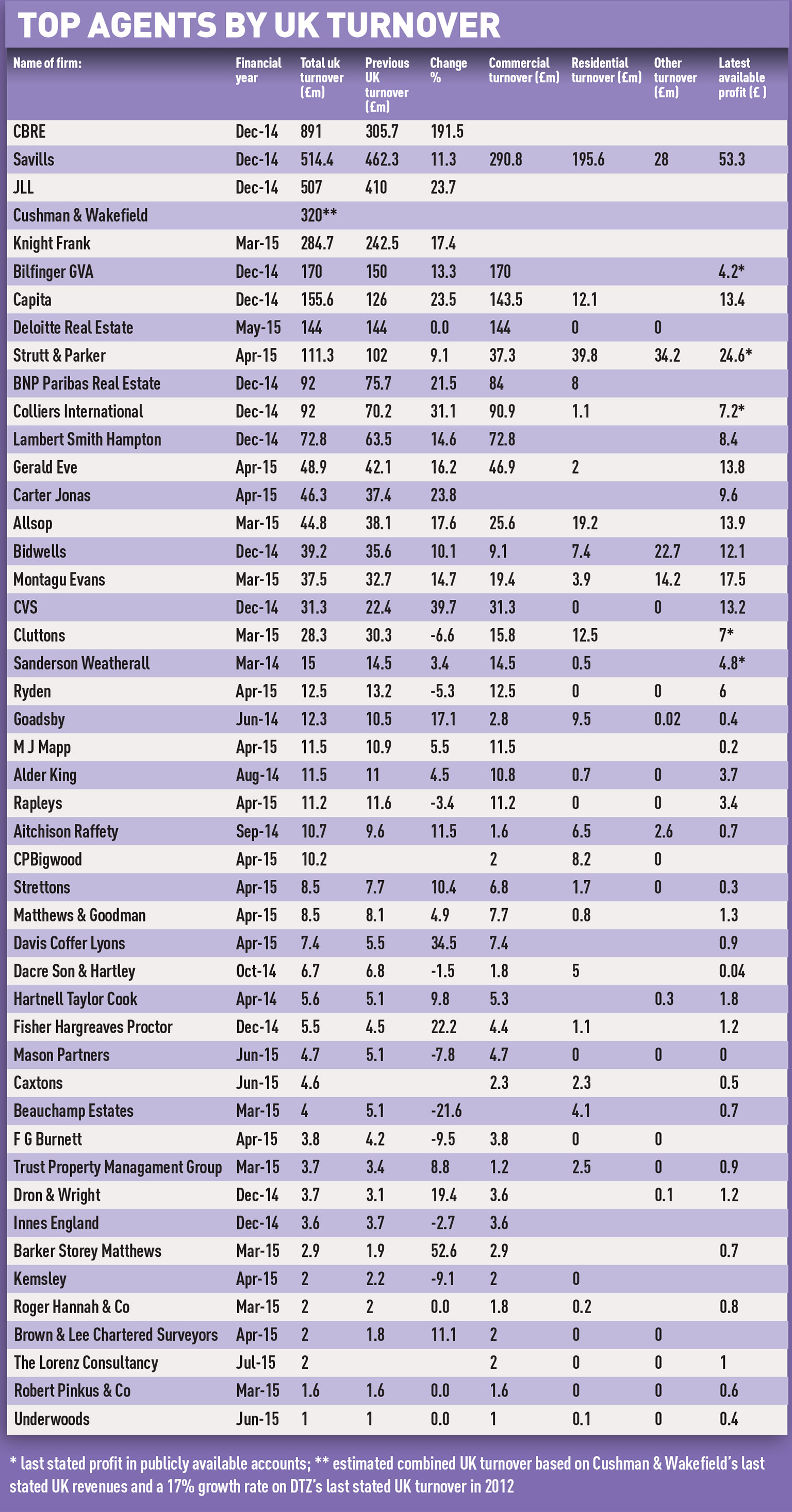

There is a new top agent in town. For the first time in the 18-year history of Estates Gazette’s Top Agents survey CBRE has taken the number one spot.

And it has done so with style.

The Big Green Giant has lived up to its nickname this year with a massive 191.5% increase in UK turnover to £891m – up from £305.7m last year. The increase is led by a boost from the agent’s acquisition of facilities management company Norland, but excludes income from the Global Workspace Solutions business it bought from Johnson Controls earlier this year.

Ciaran Bird, UK managing director, said: “We are obsessive about understanding and anticipating our clients’ needs and continue to diversify our business to provide the services and strategies that help them gain a competitive advantage.”

He added: “The acquisition of Norland has already contributed to the growth of our business through significant client wins and additional fee income.”

The spike has catapulted CBRE from third place last year and put it comfortably ahead of Savills and JLL – both of which boast a UK turnover of more than half a billion pounds. It is the first time since 2011 that Savills has been denied the top spot.

Growth drivers

- 1 Acquisitions

- 2 Investment fees

- 3 International capital flow

- 4 Global corporate services

- 5 Facilities mangement

- 6 Global expansion

Biggest challenge

- 1 Staff retention

- 2 Pressure on margins

- 3 Rising interest rates

- 4 Lack of debt

- 5 Lack of occupier demand

- 6 Problems in the eurozone

- 7 UK political uncertainty

Cushman & Wakefield, following its takeover by DTZ, was the other big mover in the top 10 this year. While the combined firm will not release turnover figures yet, EG estimates put its UK revenues at around £320m, pushing it from seventh place last year to fourth this year. The rest of the top 10 stayed largely the same.

The figures reflect a buoyant agency market, with 23 of the 47 companies that submitted data reporting at least double-digit growth. Total UK turnover for the country’s top agents was up by more than 50% to top £3.8bn.

Alongside CBRE’s dramatic growth, CVS, Davis Coffer Lyons and Barker Storey Matthews were top performers.

East of England-based surveyor Barker Storey Matthews saw turnover increase from £1.9m to £2.9m over the year and added some £500,000 to its profits. And it expects further growth over the coming 12 months, with the only concerns being a lack of stock and quality staff.

The firm said: “The outlook for commercial property remains positive, with rents and capital values increasing across all sectors.”

Rating specialist CVS reported an almost 40% rise in its turnover during the year to £31.3m with profit more than doubling to £13.2m. The rise was aided by the addition of a new business rents service.

Chief executive Mark Rigby expects CVS to double in size from a financial perspective over the next three to five years. “There’s a strong outlook,” says Rigby, “plenty of petrol left in the tank!”

In the specialist sector, the growth in the leisure market has helped Davis Coffer Lyons post a 34.5% increase in turnover from £5.5m last year to £7.4m in this year’s Top Agents survey.

The firm said: “The central London restaurant market continues to attract exciting new operators as well as some of the best overseas brands. This demand, coupled with landlords’ willingness to create destinations, will ensure the market stays strong.”

• Scroll down for a breakdown of turnover and rank for every agent in our survey over the last 18 years.

Click on the graphic below to see how the fortune of the top three agents has changed over the last 18 years. Click on the buttons to change the view. Hover over the lines to see absolute values.

Can’t see a graph below? Click here

Can’t see a graphic below? Click here

Can’t see the graph below? Click here