The purchase of Cushman & Wakefield from the Agnelli family by DTZ has thrust the purchaser’s controlling company, TPG, into a spotlight it rarely seeks, even as one of the largest and most powerful financial institutions in the world.

The purchase of Cushman & Wakefield from the Agnelli family by DTZ has thrust the purchaser’s controlling company, TPG, into a spotlight it rarely seeks, even as one of the largest and most powerful financial institutions in the world.

The US private equity firm has interests in businesses as diverse as taxi firm Uber, Hollywood agent CAA and fast-food chain Burger King.

With a portfolio valued at $67bn (£43bn), it is one of the largest private equity firms in the world – fifth overall in terms of assets under management – and is exceeded only by Carlyle, KKR, Blackstone and Apollo.

Unlike its peers, the firm remains a resolutely private company, with no public listing for either the outfit as a whole or for the individual platforms that it manages.

The company is owned and run by its partners, headed by David Bonderman, the billionaire former civil rights lawyer who founded the company in 1992 with James Coulter.

TPG, originally Texas Pacific Group, operates across a variety of different investment platforms, including special situations, real estate and renewable energy funds.

The central platform of the business is TPG Capital, a multi-billion-dollar takeover and restructuring fund that invests in established companies.

It is within this platform, and more specifically the platform’s latest TPG Partners VII fund, that DTZ and the acquisition of C&W sit.

At $2bn, the C&W acquisition is by no means the largest that the company has undertaken, but the fund’s backers will hope the company has more success with the investment than it has with some others in its recent history.

Two investments made before the crash of 2008 turned distinctly sour.

In 2007, the company’s record-breaking takeover of utility company TXU, now Energy Future Holdings, for $48bn eventually led to it seeking Chapter 11 protection in July last year.

Its $1.4bn takeover of Washington Mutual Bank in 2008 ended with the US government taking over the bank and a subsequent total loss to TPG and its investors.

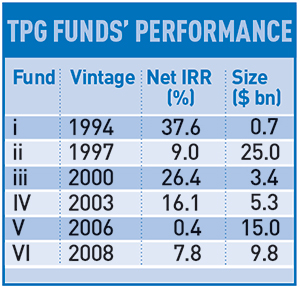

The failings of these investments led to the 2008, $19.8bn, TPG Partners VI fund falling below its return targets, and well below historic returns (see table).

TPG has now changed its strategy from large equity investments to focus on smaller companies or joint ventures, such as the DTZ buy-out from Australian services giant UGL in 2014.

According to minutes from cornerstone investor Oregon Investment Council’s investment committee in January, TPG is now focusing on a more mid-market approach, taking controlling stakes using between $250m and $600m of equity in companies valued at up to $3bn. It previously invested in companies valued at as much as $30bn.

If TPG and its partners leverage their C&W purchase to the same level as TPG’s previous deals – up to 80% – the company could be left with considerable debt.

Assuming TPG keeps to its traditional investment criteria, the fund the agency business is held in will run for another seven years, extendable by investor vote.

Of five investments publicly announced – including Ping An Insurance in Asia, online housing rental guide RentPath and a distressed loan portfolio from Corus Bank – all have closed out within seven years.

It is widely expected that TPG will look to dispose of the new Cushman & Wakefield business by 2021, depending on the returns the company can make for the fund in the period.

Earlier this year TPG purchased the US real estate special situations book of Deutsche Bank, along with a number of staff, in a statement of intent in real estate investment.

The company has also taken control of real estate companies such as P3 Logistics Parks and Evergreen Industrial Properties.

However, the C&W purchase may seem shrewder than any of these. Combined with DTZ, the company has a critical mass that could make a bigger impact on the market than arguably any other single real estate-led investment TPG has made, owing to the agent’s global reach and penetration of so many different markets.