The problem with something as fast-paced and all-encompassing as technology is trying to pinpoint the latest trends and patterns – especially for a traditionally slow-moving sector like real estate. But help is at hand courtesy of the KPMG Technology Trends Index.

The KPMG Technology Trends Index is the first in the world to provide a dynamic, live view of technology trends. It tracks approximately half a million online sources per day, and filters them to evaluate the activities related to 25 selected trends. The snapshots covered in this article are based on data between 21 September 2018 and 9 April 2019, but a real time view can be seen online at technologytrendsindex.kpmg.com.

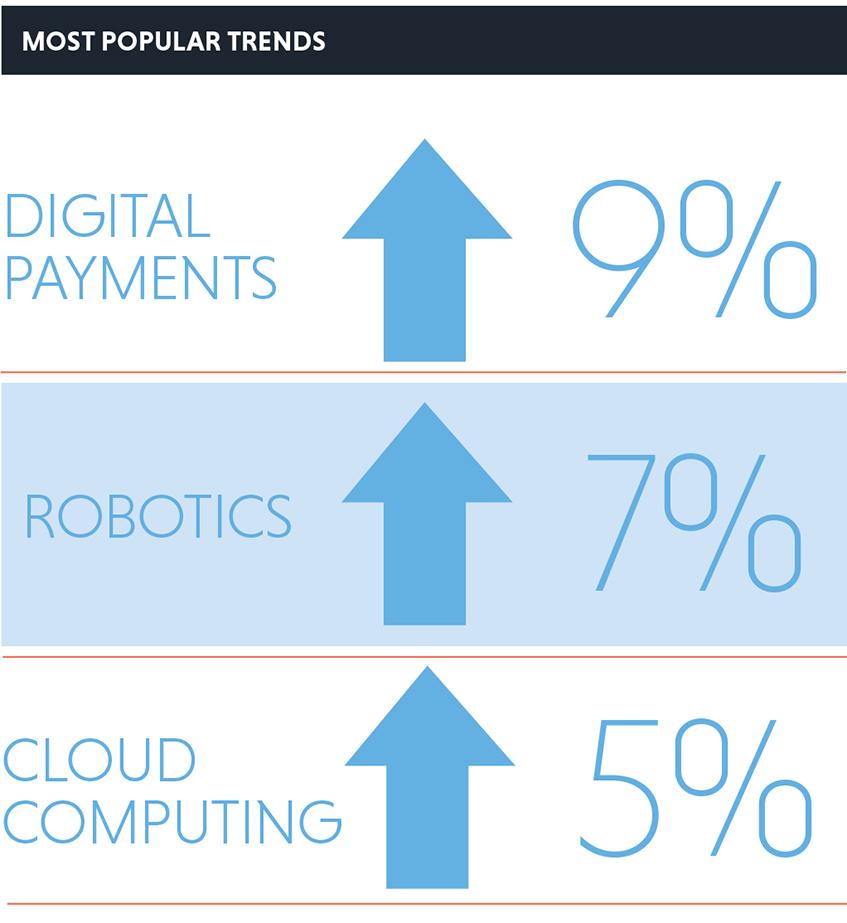

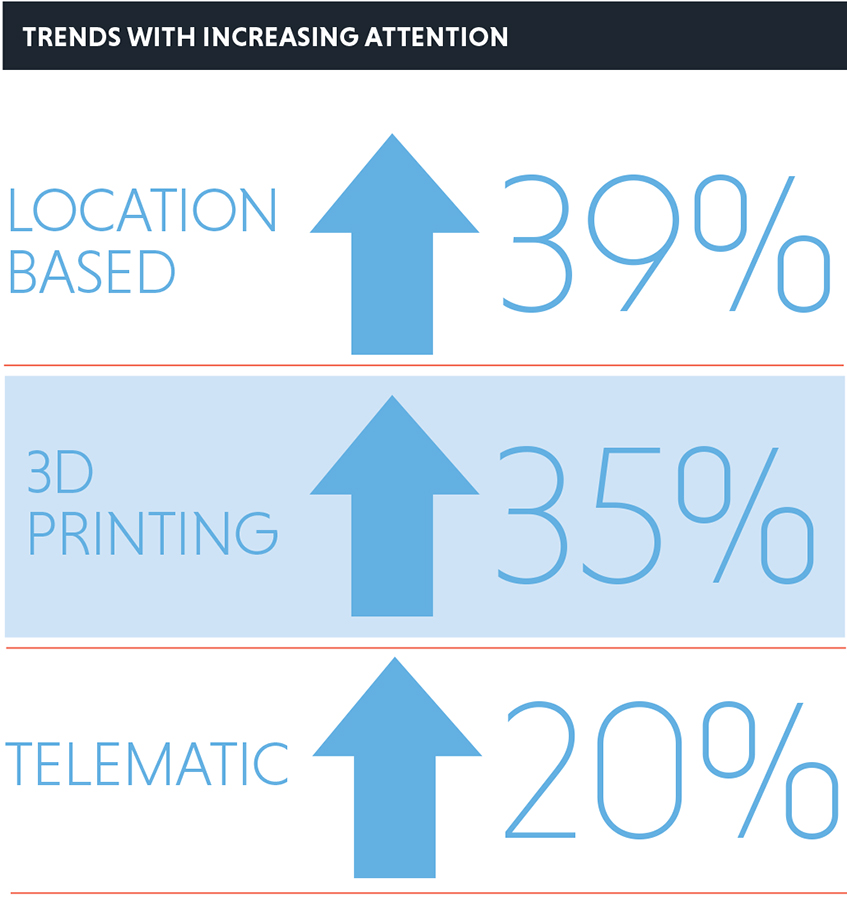

Here we outline the three most popular trends recognised by the index, as well as the three gathering increasing attention – all are set to revolutionise how we engage with aspects of the built environment.

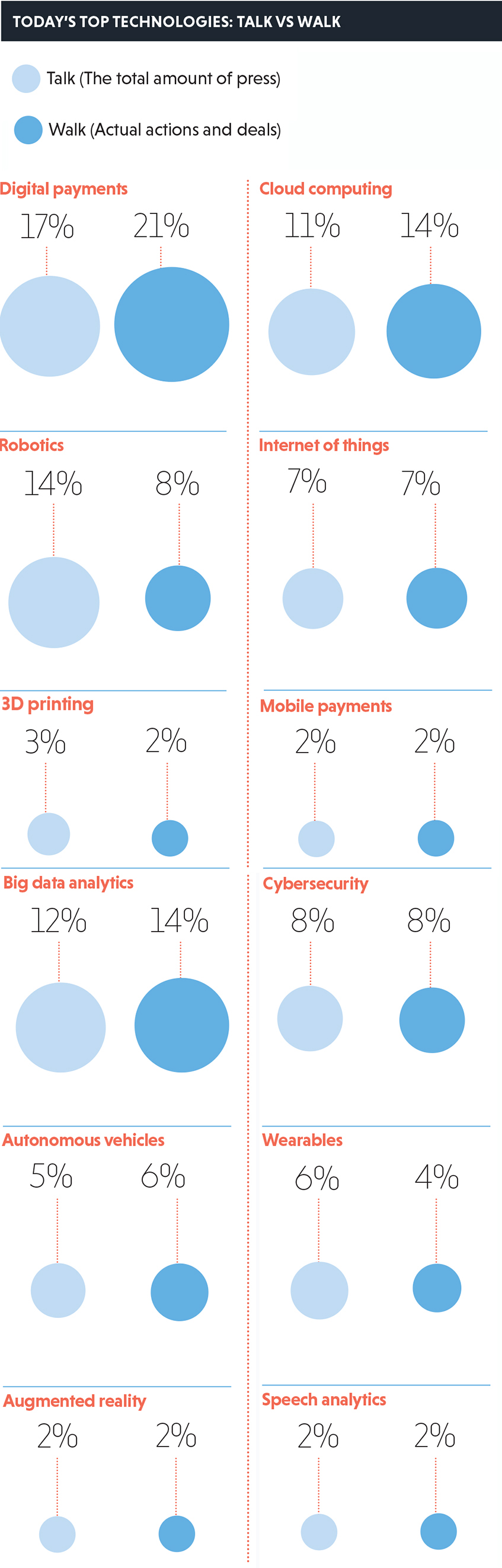

We also look at the current top trending technologies in terms of press coverage against actual action and deals, to see how the reality stacks up against the buzz.

Buzz top three

The latest wave of digital payment technology, driven by a desire for faster payments (both in-country and cross-border) has fuelled a wave of digital challenger banks entering the market. Names such as Starling Bank, TransferWise, Atom, Monzo and Revolut were unheard of a few years ago, but are already receiving eye-watering valuations, with Monzo reportedly valued at close to $2bn (£1.5bn) after its latest fundraise.

But it is not just the new players. Incumbent technology firms are starting to partner with banks to change how we pay for items and pay each other.

So, what does this mean for the built environment? We have already seen retailers move away from the cashier model, where people queue at checkout points to pay for items. But, in an ever-changing retail world that is becoming focused around user experience, could digital payment technology encourage shoppers to self-serve at check-out? If so, what does this mean for how retailers use space? One benefit could be the ability to segregate browsing from collection, with digital self-serve payments acting as the bridge between the two.

Having a shopping centre’s full inventory at a collection point on exit would create a more efficient usage of floor space, and allow people to continue shopping unimpeded by bags. This is already being done on a store-by-store basis, but an efficient digital payment platform might allow it for the whole shopping centre.

Trending

In any real estate digital transformation programme, data is a core part of the future operating model – data to understand how people use assets, data to understand how the asset performs, and data to make better investment decisions. Until recently, data collection around users has started and ended at the building threshold.

However, technology has blurred the lines between the three core activities of live, work, play, and many activities encompass more than one of these. If we are going to plan and build the developments that will support these changing consumer habits, it is vital that we understand how people behave across all three.

City-level potential

Location-based data and analytics is key to providing insight around the activities people do before and after they enter a building. A work day doesn’t begin when a person steps into the office, but when they wake up.

Beyond simply looking at how a building can provide better amenities based on this data, there is untapped potential at the city level. What if your public transport journey and non-time bound chores or activities were replanned in real time based on congestion and disruptions? Instead of going to the shops in the morning, your calendar could tell you to do it during a slot in the afternoon, because of anticipated rain or road closures. What if e-commerce deliveries were planned on where people are expected to be during a specific 10 minute window, as opposed to a half day slot at a fixed address?

Location-based data and amenities have the potential to improve quality of life, but must also be balanced with risks surrounding data privacy.

Andy Pyle is head of UK real estate at KMPG