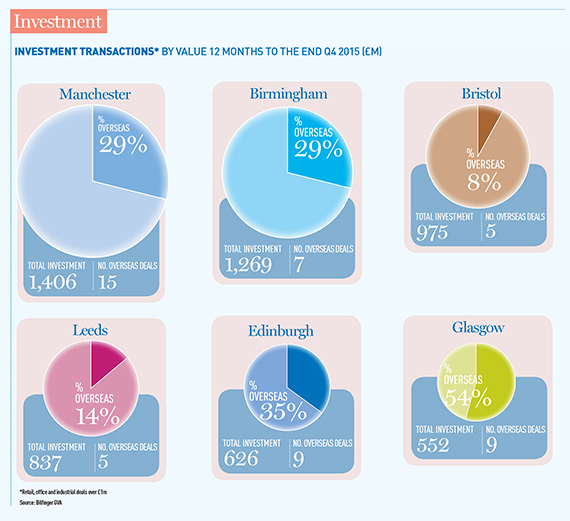

Key facts

Key facts

£705m

the amount transacted in Leeds in the second half of 2015, compared to Manchester’s £380m

54%

Glasgow had the highest proportion of overseas investment

15

Manchester had the highest number of overseas deals

25%

Manchester had the highest proportion of total investment

Commentary

Birmingham

“The major regional office markets in the UK have been recognised for years by domestic and European investors as offering an attractive alternative to London, and now Birmingham is firmly on the radar of investors from the Far East and Middle East.

“The Urban Land Institute (ILU) report placing Birmingham in the top 10 of global investment destinations has reinforced this. But the real drivers are massive infrastructure improvements (New Street Station, Birmingham Airport), groundbreaking development schemes (Grand Central, Paradise),

and real people moving to the city (Deutsche, Brindleyplace and HSBC, Arena Central).”

Barry Riley, associate, investment at Bilfinger GVA

Manchester

“The big story of 2015 is the performance of the investment market where, at the prime end, transaction levels and pricing achieved record levels, due to huge domestic and international capital flows and poor returns in other asset classes.

“Manchester offers good value compared with London and the South East, where much of the investor market is priced out. Manchester will always be a focus for occupational and investor interest attracted by its international brand and its stable and embracing civic infrastructure.”

Mark Rawstron, regional senior director at Bilfinger GVA

Edinburgh & Glasgow

“Prime office yields in Edinburgh and Glasgow are now breaking through 5.5%. These levels are still slightly softer than those achieved over the past 12 months in Manchester and Birmingham, which leaves room for further compression through 2016 as prime office investment opportunities reach the market.

“The supply/demand dynamics going forward favour higher levels of rental growth in Edinburgh than Glasgow, as there are fewer ongoing developments and much of Edinburgh’s grade-A development pipeline is nearly two years from completion.”

Jamie Thain, director, investment at Bilfinger GVA

Bristol

“We believe that 2016 will see a period of consolidation, in that investors are looking to invest, but will not aggressively push assumptions in order to hit returns. In order for the market to see liquidity, vendors must appreciate pricing and must have a desire to sell.”

Richard Howell, director, investment at Bilfinger GVA