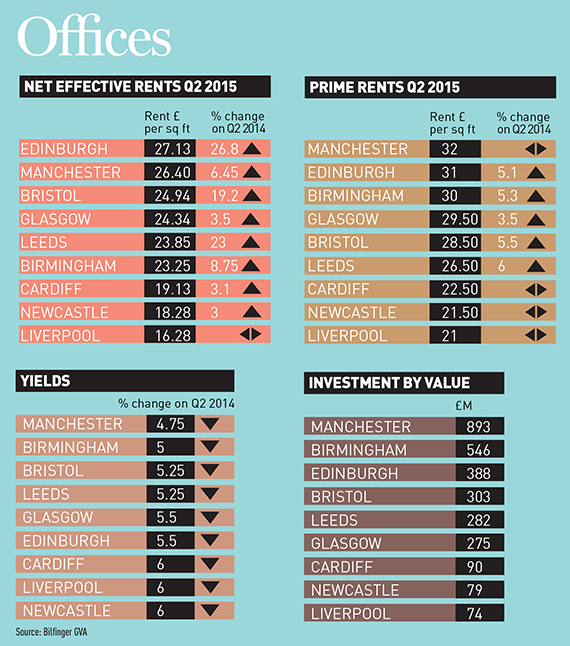

Edinburgh posts the biggest rent rises, while Manchester posts the lowest average yield, 4.75%, and turns in the biggest transaction volume by value during Q2 2015.

Key facts: offices

Key facts: offices

£27.13

Net effective rent in £ per sq ft for Edinburgh – the highest of the big nine

4.75%

Manchester has the lowest office yields

1.2m

The amount in sq ft of space taken up in Manchester in 12 months to Q2 2015

6%

Leeds saw the biggest rise in headline office rents in the 12 months to Q2 2015

27%

Edinburgh saw the biggest rise in net effective rents in the 12 months to Q2 2015

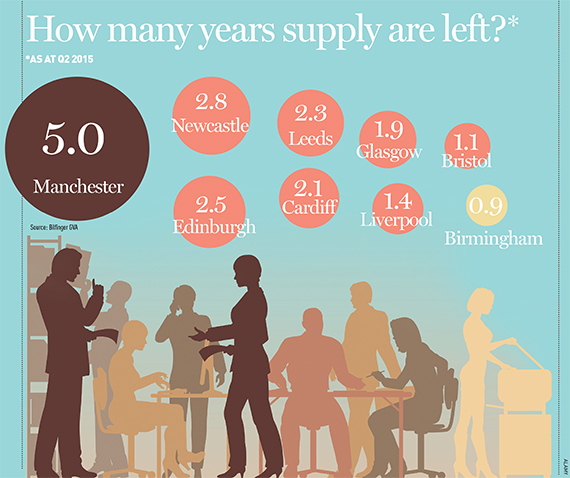

Bilfinger GVA talks future supply

Glasgow Alison Taylor, director

“There is no development pipeline beyond those completing this year and the earliest new delivery won’t

be until 2018. We predict a race to bring forward new developments, and those with cleared, consented sites will benefit.”

Manchester Chris Cheap, senior director

“Within six schemes, there is just over 1m sq ft of space consented and committed, which will be delivered over the next three years. Around 20% of this supply is pre-committed and, based on average grade-A take-up, the residue represents some 2.5 years’ supply.”

Edinburgh Peter Fraser, associate director

“Only six buildings in central Edinburgh are capable of securing a 30,000 sq ft requirement on contiguous floors. About 220,000 sq ft in two speculative buildings is under construction. It is unlikely further schemes could be completed in 2017.”

Leeds Matthew Tootell, director

“There is some 500,000 sq ft of new grade-A stock under construction, of which there is only 378,000 sq ft available. Leeds city centre 10-year average grade-A take-up is 250,000 sq ft per annum.”

Birmingham Charles Toogood, senior director

“With take-up in central Birmingham already totalling 650,000 sq ft in H1 2015, take-up by year-end is expected to exceed 900,000 sq ft – potentially the highest figure ever recorded.”

Bristol Richard Kidd, director

“Major conversions of up to 1m sq ft of secondary city-centre stock into mostly resi or hotel uses has created a marked lack of grade-A supply and an increased demand for grade B.”

Cardiff Tom Merrifield, associate director

“Cardiff’s grade-A supply shortfall is a concern. A handful of sizeable completions will offset it, but will only delay an impending supply/demand tipping point. With a number of major requirements circulating, this may expedite the supply drop and leave the city exposed.”

Liverpool Ian Steele, director

“Only 68,000 sq ft of new space is available. Large grade-A floorplates are rare. No new office schemes are under construction or due on site within the next six months. Nonetheless, Peel has secured consent for No 5 Princes Dock at Liverpool Waters, adding 81,000 sq ft into the supply chain. The scheme is likely to require some pre-commitment before it starts on site.”

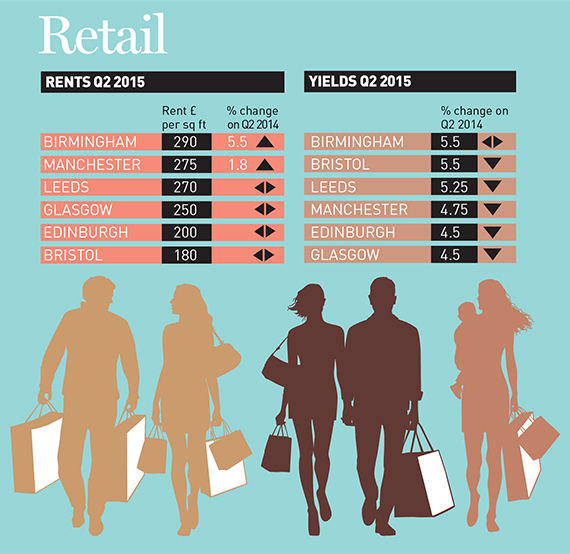

Key facts: retail

Key facts: retail

5.5%

The rise in Birmingham retail rents in the 12 months to Q2 2015

£180

At £180 per sq ft Bristol has the lowest retail rents of the big six

4.5%

Edinburgh and Glasgow have the lowest yields

75bps

Leeds has seen the sharpest compression in yields

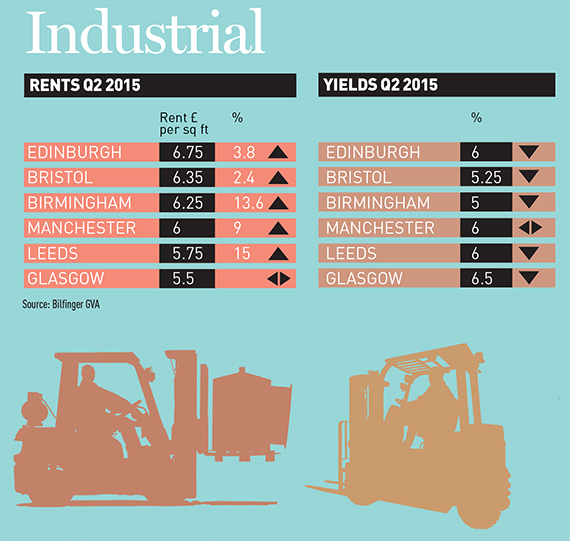

Key facts Industrial

15%

Rise in Leeds industrial rents in the 12 months to Q2 2015

5%

Birmingham has the lowest

yield of the big six

£6.75

Edinburgh industrial rents

are highest