Laxfield Capital’s UK commercial real estate debt barometer shows demand has recovered slightly in Q1, but there are still challenging conditions for borrowing against non-core assets.

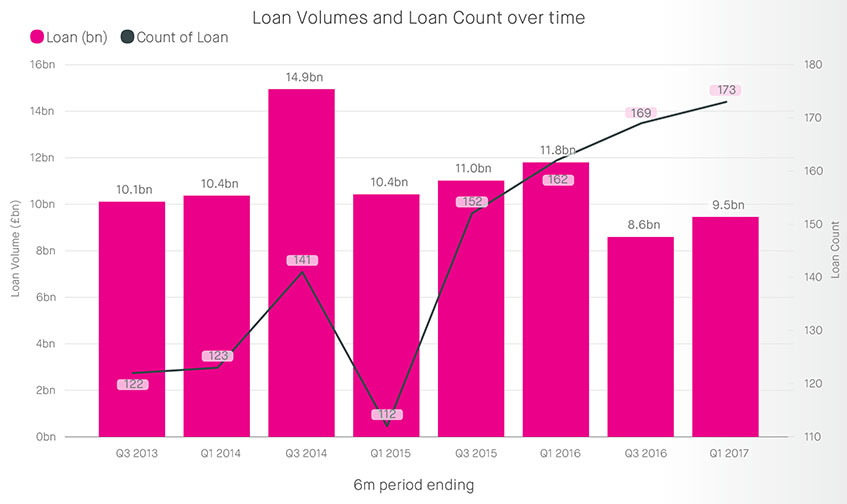

The barometer measures requirements when borrowers approach debt providers seeking terms. It references requests for funding received since January 2013, drawing on a sample of 1,681 loan requests totalling more than £110bn.

Volumes rose by 10.3% to £9.4bn in the last two quarters from previous low levels during the period around the EU referendum, when there was notably suppressed demand.

Pricing over the six month period to 31 March covered by the report increased across the pool, despite a consensus that lenders were competing strongly for business and pricing was predicted to contract.

The pricing pattern reflected concentration of debt in ‘core’ and ‘high yield’ (which have seen margin compression), in contrast to the middle area of deals between 55-70% LTV where the senior debt market has become more reticent and pricing has increased.

Laxfield found this was particularly noticeable for secondary assets where margins have risen substantially.

Key findings of the latest report also included sustained demand for small and mid-market loans and a notable number of requests from borrowers seeking refinancing for challenging assets.

A possible mismatch between regional demand and supply was also recorded.

Emma Huepfl, co-principal of Laxfield Capital, said: “The market is increasingly fragmented. Demand is not matched by efficient supply in the regions; and outside core, the increasing cost of debt to borrowers may be a barrier to investing in, and improving, value-add assets.

While appetite to lend may appear strong, in practice it can be hard for borrowers to access funding without deep relationships and core assets to help support more entrepreneurial activities.”

Some 24 new loans for development deals totalling £1.4bn were recorded over the past six months. Volumes were slightly below the three-year average, but loan count was strong, resulting in a relatively small average deal size of £58m.

Laxfield said this may reflect hesitancy around commitment to large scale developments.

A shift away from schemes in London was also in evidence, with the highest-ever number of regional deals accounting for 43% of the pipeline.

Rob Short of the Property Finance Forum, which sponsored the report, said: “Laxfield has identified liquidity issues which are important for the market, and continue to challenge lenders who are often polarised between the very risk averse or high-yield lenders. Borrowers need to work hard to match funding to business plan in challenging macro-economic conditions.”

To send feedback, e-mail Louisa.Clarence-Smith@egi.co.uk or tweet @LouisaClarence or @estatesgazette