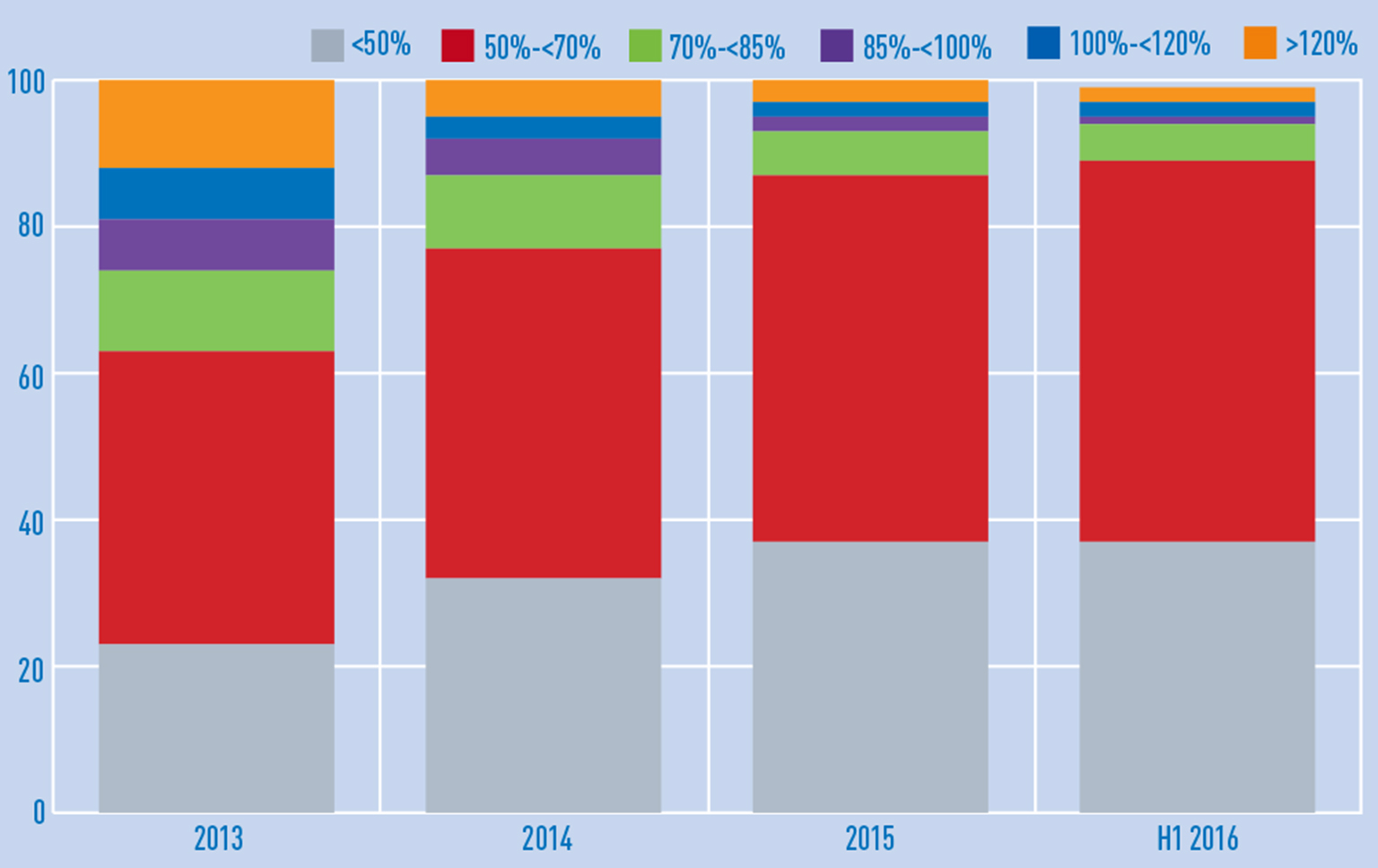

Lenders to UK commercial property are de-risking their portfolios as nine out of 10 loans outstanding now have a loan-to-value ratio of 70% or below, according to the half-year De Montfort Commercial Property Lending Report.

Lenders to UK commercial property are de-risking their portfolios as nine out of 10 loans outstanding now have a loan-to-value ratio of 70% or below, according to the half-year De Montfort Commercial Property Lending Report.

The average LTV of loans issued by UK banks and building societies during the first half of 2016 came in at 59%, down from the 65.6% reported at the end of 2015.

Among all 78 lenders in the study, loans with an LTV of more than 70% account for only 11%, down from 37% in 2013. The biggest fall came from loans with an LTV of more than 120%, down by 10 percentage points to 2%.

Nicole Lux, author of the report and senior research fellow at De Montfort University, said that the study confirmed the caution felt in the industry.

She said: “Last year was a record year, and that could not really continue. Everyone was aware that pricing was at the peak in the property market and decided that they didn’t want to expand further on LTV ratios.”

Although loan origination fell by 13%, year-on-year, to £21.5bn, the drop was notably smaller than the drop in transaction volume, which fell 35% in the same period.

Lux said: “I expected a much bigger drop in origination volumes. We had £24.8bn in the first half of 2015 and we’re at £21.4bn, so we were really just £3bn off.”

Part of the reason for the difference between loan and transaction volumes was the relative rise in refinancing deals, which made up 51% of all loan originations.

Meanwhile, the percentage of loans for new acquisitions had fallen to 49% from 61% in 2013 following the dive in transactions.

Origination volume by type of lender

After years of decline, UK banks and building societies have had a sharp rise in their market share in loan origination, up from 34% to 44% in the first six months of the year (see above).

But this says more about the inactivity of other lenders than about the banks themselves, which cut their total lending by 2% in the period. Insurance companies, which reported a 238.2% increase in activity between 2012 and 2015, loaned £2bn in the first half of 2016, a year-on-year fall of 42%.

Meanwhile, margins for prime UK offices and retail have fallen to below 200 bps, making those sectors less desirable for North American lenders able to find higher margins closer to home.

As a result, only 7% of new loans in H1 2016 came from North American banks, down from 14% at the end of 2015. Once margins start to rise again, US investors could come back as they did in 2014 after a few years of a post-crisis lull.

ORIGINATION VOLUME Source: De Montfort Commercial Property Lending Report

| ENTITY | END 2015 (£BN) | H1 2015 (£BN) | TOTAL ORIGINATION H1 2016 (£BN) | % CHANGE |

|---|---|---|---|---|

| UK banks and building societies | 18.3 | 9.7 | 9.5 | -2 |

| German banks | 7 | 3.1 | 3.6 | 13 |

| Other international banks | 7.5 | 3.6 | 3 | -16 |

| North American banks | 7.5 | 2.4 | 1.5 | -35 |

| Insurance companies | 8.6 | 3.5 | 2 | -42 |

| Other non-bank lenders | 4.8 | 2.5 | 1.8 | -27 |

| All lenders | 53.7 | 24.8 | 21.5 | -13 |

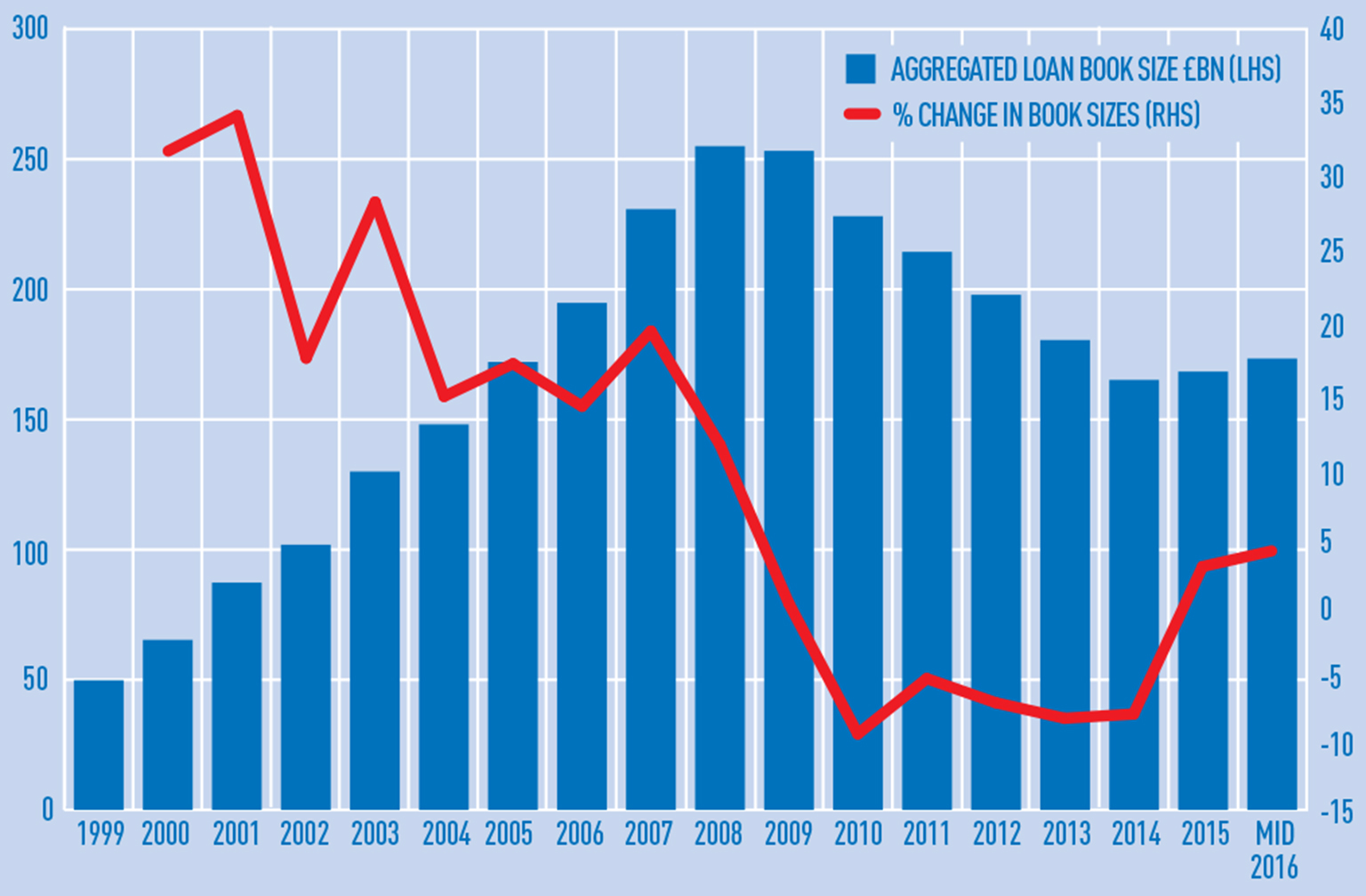

Total outstanding loan books over time

The total size of UK loan books rose by 3% to £173.4bn in H1 2016, the biggest increase since 2008. Of these loans, 77% were held by banks and building societies, 15% by insurers and 8% by other non-bank lenders.

De Montfort estimated another £22.6bn in loans were held by entities not taking part in the study, along with £17.7bn in loans that were committed but not drawn by June.

UK banks made up 46% of all outstanding loans following a year-on-year rise of 5%. This was the biggest increase in proportion by the sector since the financial crisis.

Loan books by LTV range over time

De-risking across the industry has led to a steady fall in LTVs. Only one in 10 loans for UK commercial property has an LTV of more than 70%, compared with more than a third in 2013.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette