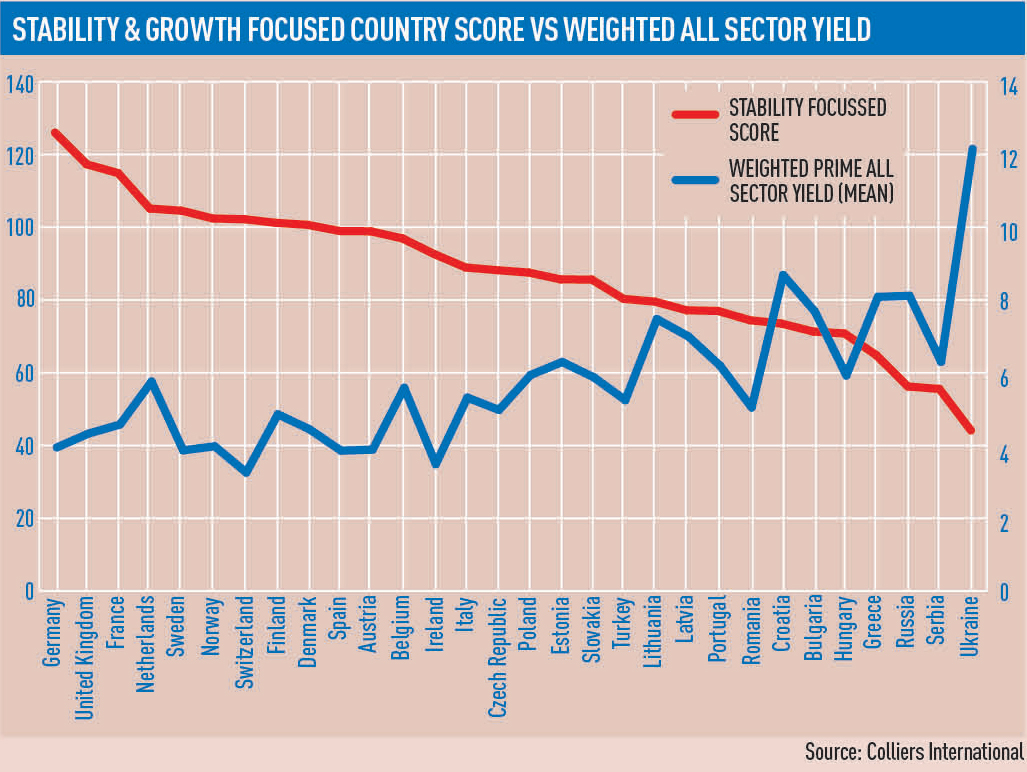

Investors with an appetite for long-term stability in Europe should still look to UK property, Colliers International’s European Investment Market Outlook report said this week.

With a record low interest rate of 0.25%, a weighted prime yield of 4.36% and a population set to grow by more than 5m by 2030, the UK’s short-term political uncertainty would not discourage investors looking for stable long-term returns, the study suggested.

Only Germany, with a yield less than 4%, scored higher on a long-term basis.

For risk-averse investors looking for liquidity, regulatory ease and transparency, the Nordics and Switzerland topped the list.

The lack of apparent risk means yields in those countries are particularly low, with Sweden and Switzerland’s average prime assets standing at less than 4%.

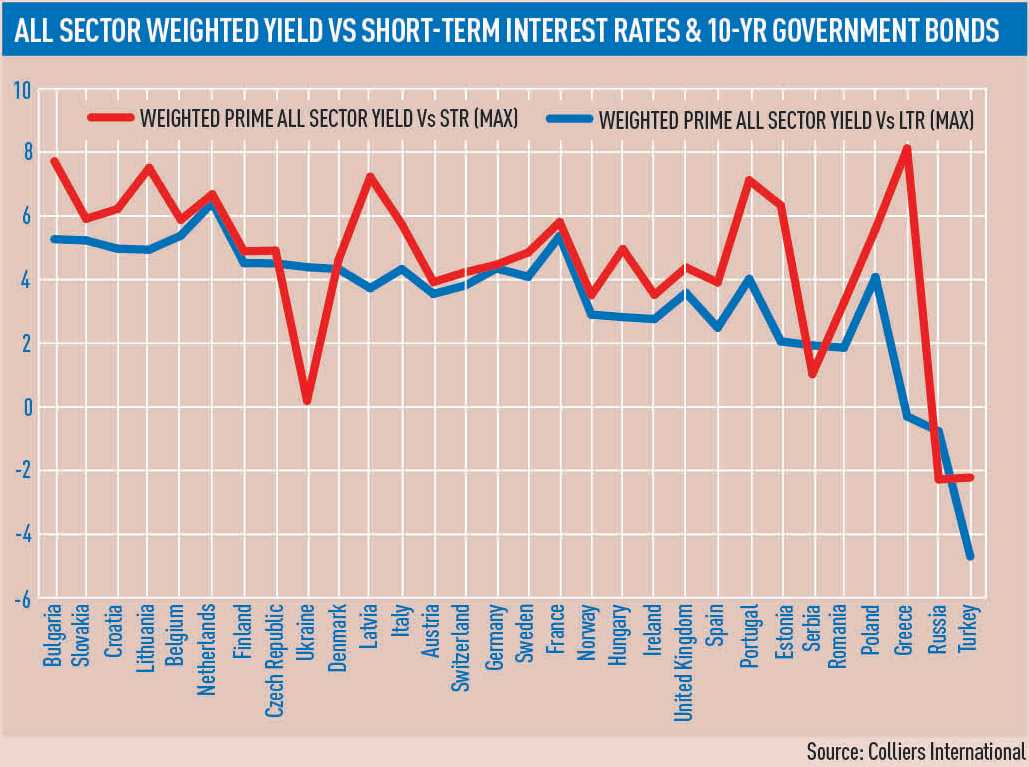

Low interest rates, which are not expected to rise in the coming years, and low yields across tier-one countries like Germany and the UK, have meant that investors chasing yields have had to turn to central and eastern Europe.

With a 7.72% gap between prime yields and the short-term interest rate, Bulgaria has shown the most opportunity for investors which have not shied away from risks in their search for returns.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette