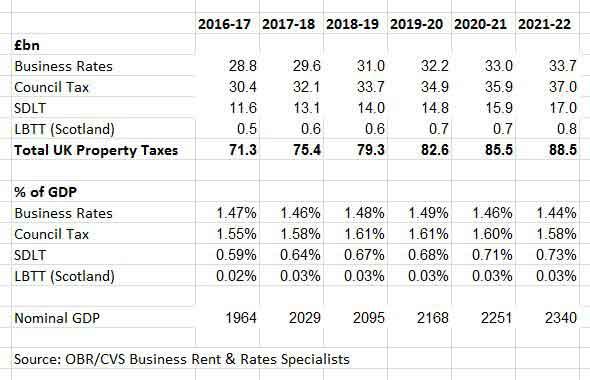

Some £17.2bn of extra property taxes are forecast to hit the industry in the next five years, an analysis by business rents and rates specialist CVS has shown.

With the Conservatives forming a minority government, property taxes in the UK will rise from 3.6% of GDP to 3.7% this financial year, and to 3.8% in 2018-19 based upon official government forecasts, the research found.

The research shows that the UK property industry is far harder hit by taxes than other European countries. In the UK property taxes as a percentage of overall taxes were 12.5% on average in the UK, compared with 2.9% in Germany, 8.9% in France and 7.1% in Spain.

CVS chief executive Mark Rigby said: “Theresa May’s government committed to cutting corporation tax to the lowest level in the G20 to 17% from 2020. But what we need now more than ever, given the current and future challenges facing the economy post-Brexit, following the triggering of Article 50, are competitive property taxes so as to ensure Britain remains well and truly ‘match fit’.”

In a letter to the main political parties, sent at the start of the General Election campaign, trade bodies, including the British Chambers of Commerce, warned that property taxes in the UK were “not financially sustainable”.

The letter warned the leaders of the three main political parties about “the challenge we face as we negotiate our future relationship with Europe, which has made reducing the burden of business rates more critical.” “The fact remains that the burden of property taxation is too high,” said the letter.

To send feedback, e-mail Louisa.Clarence-Smith@egi.co.uk or tweet @LouisaClarence or @estatesgazette