REITS are beginning to turn away from becoming income-driven companies and are focusing on development to drive returns, according to new research from Green Street Advisors.

REITS are beginning to turn away from becoming income-driven companies and are focusing on development to drive returns, according to new research from Green Street Advisors.

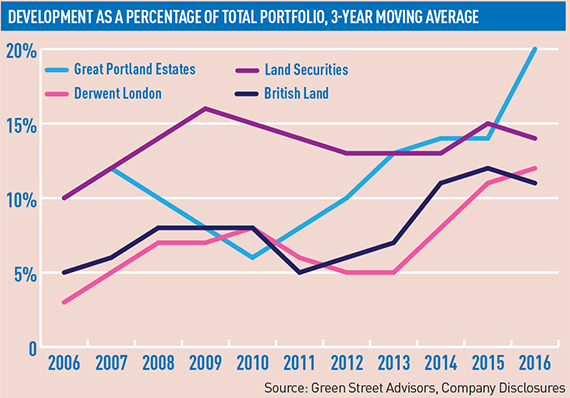

The share of business devoted to development has more than doubled from 7% to 14.3% between 2007 and 2016, on a three-year rolling average basis, at British Land, Land Securities, Great Portland Estates and Derwent London.

Andrew Jones, chief executive of LondonMetric – which has only 2.7% of its portfolio tied up in development – slammed the approach. He said: “There is too much focus on NAV. Real estate is a total return investment and return comes from income and income growth. That’s what REITs were designed to do –assuming their policy is a proper REIT strategy as opposed to just looking at it as a tax wrapper.”

Great Portland Estates’ development made up 26% of its total portfolio in the year ending in March, up from 9.1% in 2007.

Toby Courtauld, chief executive of Great Portland Estates, highlighted the company’s 1.7m sq ft development pipeline in its half-year results last month, adding that the team working on it had “never been busier”. Land Securities’ Rob Noel also stated his intentions to develop speculatively again.

However, British Land cut its speculative development to 5% in the first half of the financial year – down from 10.6% in 2015 – and development overall stands at only 6%, with the company citing a need for greater caution due to uncertain market conditions.

When REITs were first introduced, it was recommended they have “minimal development activity”, acting as low-geared investment holding companies focusing on steady income.

Green Street Advisors said that a focus on development could boost NAV – a main investor metric – although it could be risky if assets become unprofitable.

Ruben Bos, an associate at the firm, said: “They are more focused on bolstering their NAV, developing their portfolio rather than just focusing on income producing assets.”

David Hunter, founder of Hunter Advisers and former president of the British Property Federation – who campaigned to establish the UK REIT regime – said that the move towards development was a natural reaction to demands for higher returns from investors.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette