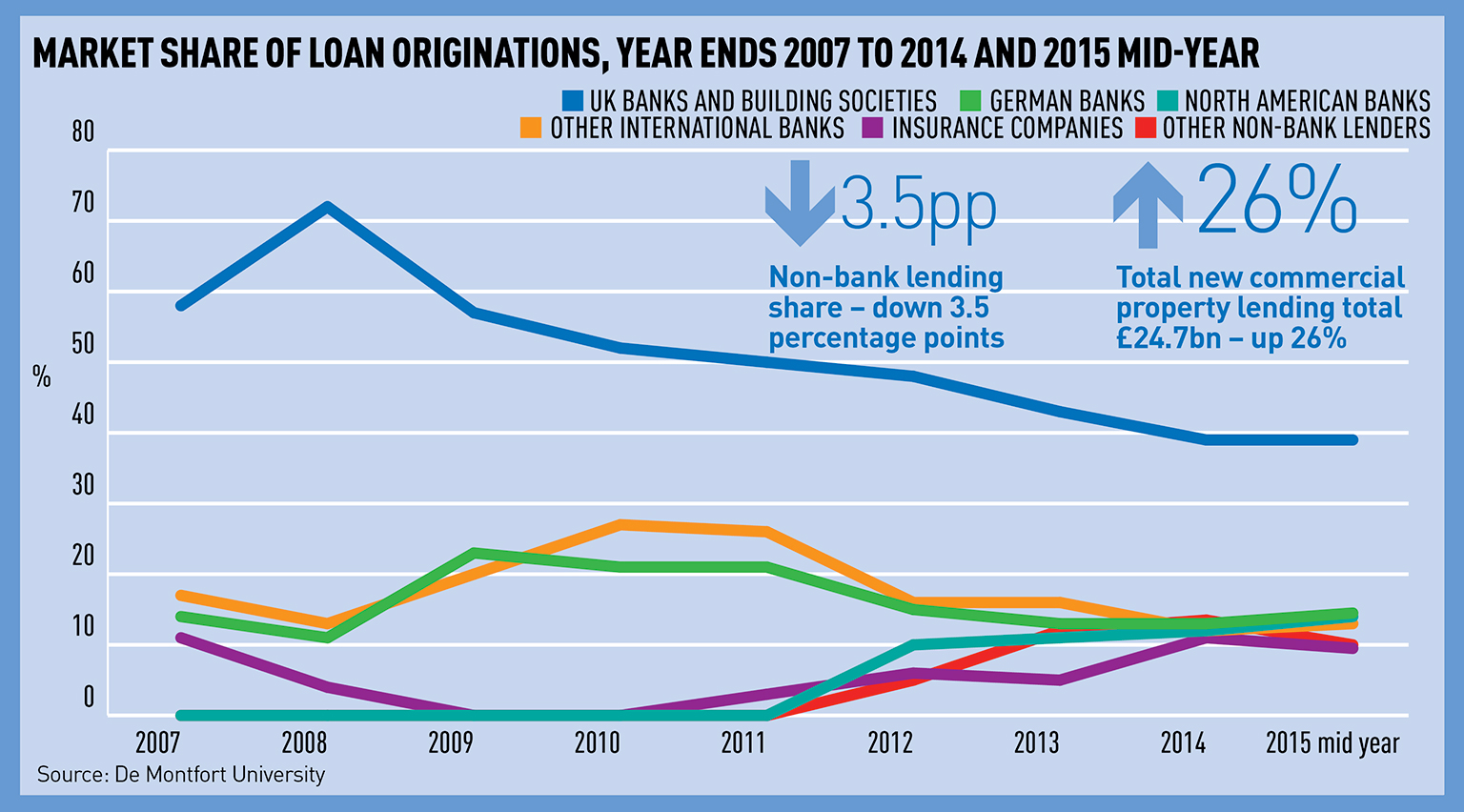

The rise of non-bank lending in the UK has gone into reverse, despite a significant increase in the volume of debt issued this year, according to research by De Montfort University.

Half of all loans were issued by just six banks, while non-bank lenders lost 3.5 percentage points of market share, meaning they accounted for 10% of the market in the first half of 2015.

It is the first time the share of new loans issued by non-bank lenders has decreased since the global financial crisis.

Their rising market share had been credited as a means of reducing systemic risk in the financial system by diluting banks’ exposure to the commercial real estate market.

North American banks also saw their market share fall – losing one percentage point to account for 9.5% of all new loans issued.

Overall, the researchers recorded £24.7bn of new lending – a 26% increase year-on-year – from 83 lenders including UK, US and overseas banks as well as insurers and non-bank lenders.

Ion Fletcher, director of property finance at the British Property Federation, said: “New origination and confidence is considerably up, and anecdotal evidence of lending from after the period of the study corroborates that.

“I would expect that the full- year 2015 figure will be higher than the full-year figure for 2014.”

Despite the increase in new lending, the volume of outstanding commercial property debt continued to fall during the period to £163.7bn.

The rate of reduction in outstanding loans has fallen significantly, from 5.1% in the first half of last year to 0.9% in the first half of 2015.

Report author and senior lecturer at De Montfort, Bill Maxted, predicts that the post-financial crisis trend for shrinking loan books will go into reverse from next year, particularly given the volume of lending by institutions that do not contribute to the report and commercial mortgage-backed securitisations that are not captured by the report.

Using publicly available data on lending from these sources, the researchers estimate that the volume of outstanding debt may have risen from £209bn at the end of 2014 to £210.6bn today.

“The value that gets reported to us has been falling, but now it is levelling off,” Maxted said.

“What we are seeing there is that the reductions are being driven by a lot less lending, and those lenders that were in the market are having to sort out their problems. A number of those banks are telling us they are nearly at the end of that process now.”

He added: “We anticipate that the amount of outstanding debt reported to us will probably start going up again.”

The volume of distressed debt outstanding was slashed by £6.8bn over the half year, leaving £14.4bn still to be dealt with.

Loan-to-value ratios of outstanding debt have also decreased, with 80% of lenders reporting their outstanding debt at below 70% LTV, up from 76.7% at the end of last year.

Some £10bn of outstanding real estate debt is in excess of 100% LTV.

De Montfort duo to retire in 2016

The team responsible for the De Montfort commercial property lending report are set to retire.

Bill Maxted and Trudi Porter, who have compiled the well-respected lending report since 1999, will step down in the summer of 2016. The pair will hand over the reins to a new team, not yet appointed, once the end-of-year report is completed in June 2016.

Since the first report in 1999 the commercial property lending data has become one of the most respected research pieces covering the sector. It receives statistics semi-annually from more than 80 lending teams and has proved to be a reliable indicator of their confidence, and sometimes over-confidence, in the sector.