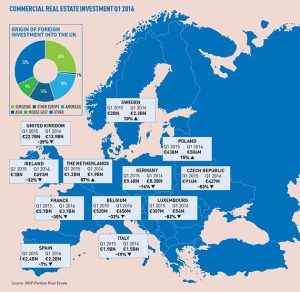

The UK saw an 83% decline in property investment from US investors in Q1, according to the latest data from BNP Paribas Real Estate.

In the first quarter of 2016, US investors accounted for only 18% of total investment, down from an average of 33% of all total foreign investment over the past 10 years.

Overall investment volumes were down to just over €13.8bn (£10.7bn) in the UK, a fall of 39%, compared with Q1 2015.

BNP PRE suggested the relative withdrawal was due to the UK market being near the top of the cycle following a record year in 2015, as well as political risk related to the EU referendum.

US investors continued to have faith in the other core European markets, however, contributing 31% of investment into Germany.

In France, 41% of investment came from the US, but, unlike the UK, where it makes up almost 60%, foreign investment comprises only 30% of the total French property investment market.

The total volume of foreign investment in Europe was down from 55% of the market to 46%.

Across the region, Asian investors reduced their deployed capital from €3.4bn to €1.7bn, a 48% year-on-year decrease, and Middle Eastern investment fell by 56% to €892m.

The story was less dramatic but still lacking in stability for other core markets, Germany saw volumes drop by 14% to €8.3bn, while France’s office market slumped by 60%, dragging overall investment down to €3.7bn.

Markets outside of France, Germany and the UK helped boost overall investment in European real estate. A total of 40% of investment in Q1 2015 was into non-core markets, up from 32% in 2015. In particular, the Nordics, Belgium and the Netherlands saw significant uplifts in investment, with Finland increasing investment volumes by 261% year-on-year.

• To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette