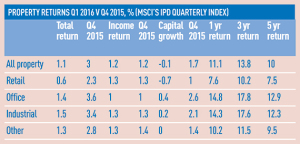

Total UK returns slipped by 190bps in the first three months of 2016 to 1.1%, according to MSCI’s IPD UK Quarterly Property Index.

It is the first fall since the first quarter of 2013.

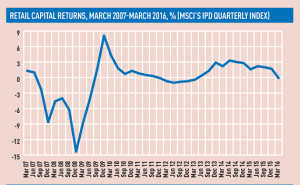

Retail assets in particular suffered, sliding from positive capital returns of 1% to a decrease in value of 0.7%.

The office and industrial sectors made marginal gains, but still saw returns slide by 220bps and 190bps respectively.

The office and industrial sectors made marginal gains, but still saw returns slide by 220bps and 190bps respectively.

Douglas Rowland, vice president at MSCI, said returns were being affected by the EU referendum.

Income returns have remained unchanged across all sectors since the end of December 2015.

Retail and industrial incomes continued to outperform offices during the first quarter of 2016, both showing growth rates of 1.3% compared with 1% for offices.

Returns for property still represented a 7.3% premium over bond returns in the 12 months to the end of March.

According to CBRE research, investment volumes in the London office market have fallen by 14% since the end of December.

The number of transactions is now at its lowest across the sector since 2010.

Overseas investors attracted by a weak pound and less competition led what limited activity there was, said CBRE.

Overseas investors attracted by a weak pound and less competition led what limited activity there was, said CBRE.

Based on the performance of 9,817 properties, IPD figures are among the most comprehensive of any for the UK.

The figures are taken from both the value of assets exchanged in the market and the quarterly valuations of participating companies.

• To send feedback, email mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette