Total trade between GCC countries and the UK has soared by 185% over the past 15 years.

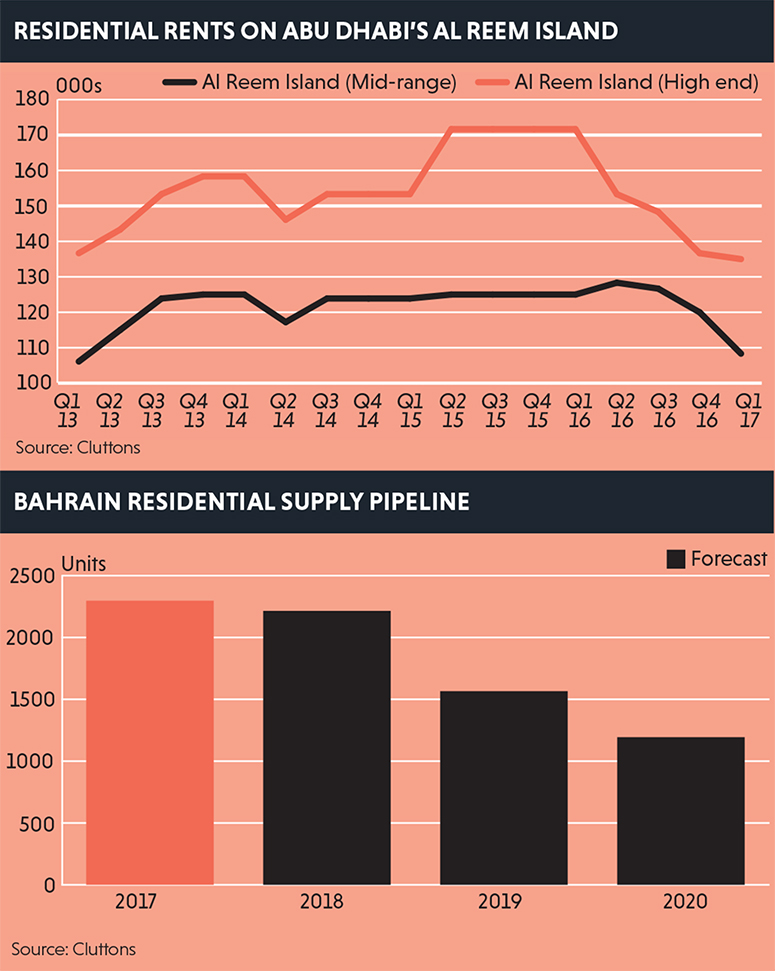

According to Real Capital Analytics, Middle Eastern real estate investors favour the West End to splash their cash, investing £344.5m in the sub-market compared with £80m and £70.3m in the City and Midtown, respectively.

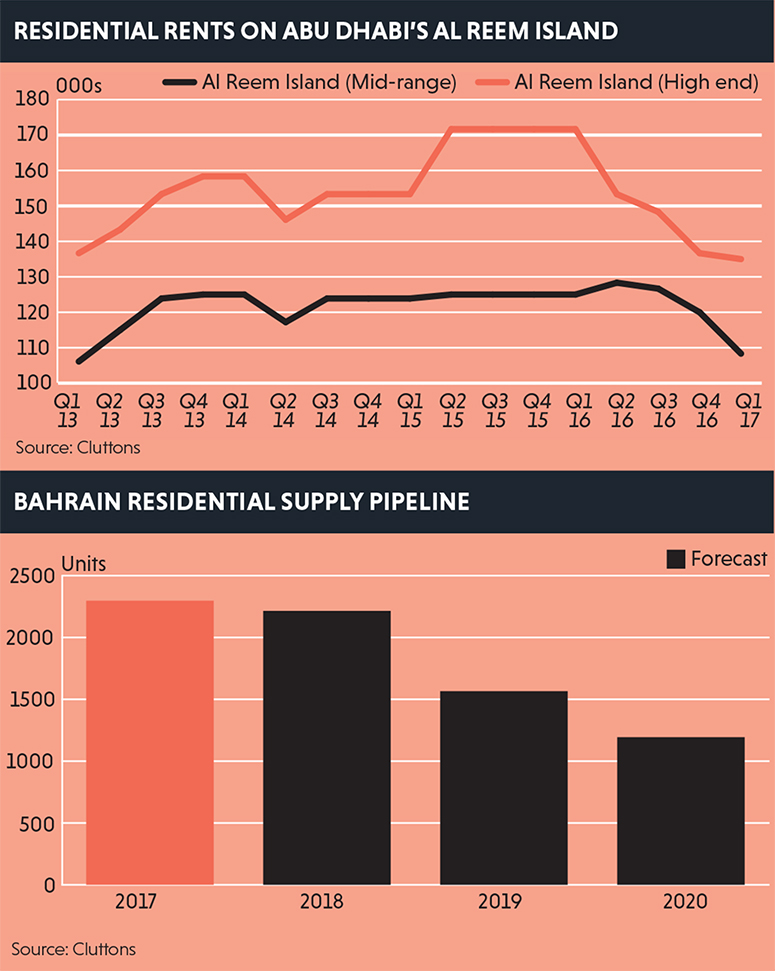

In the GCC countries, Cluttons’ latest data shows that in Abu Dhabi housing affordability has come into focus, with high-end areas such as Al Reem Island experiencing rental weakness.

While in Bahrain, a surge in residential development, expected to be bought by Gulf investors and filtered through to the rental market, is likely to cause a correction in residential values.

1m sq ft Amazon warehouse in Edinburgh bought by Rasmala and Kamco

£50m Paid by Sharjah fund to convert building to flats in Chelsea

£4bn Qatar government’s UK investment plan

£300m Abu Dhabi investment in Liverpool shopping mall