Offices have led real estate investment deals in the UK so far this year following an uptick in transactions in central London from mid-September.

The asset class accounted for 26% of all transactions in the first three quarters of 2023, according to data from Savills in its October Market in Minutes report.

It pegged West End offices as one of the asset classes ripe for the picking in the next phase of the UK real estate investment market cycle going into 2024, alongside prime logistics.

Both asset classes are predicted to offer positive rental growth in the coming months despite ongoing tough economic conditions, as well as some yield hardening over the next five years.

As a result, Savills predicted that they would be first to see pricing recover when economic conditions level and the market regains its footing.

The agency also noted that the stabilisation of UK interest rates is reflected in Savills all-sector prime yield, which remained at 5.75% in September.

Mat Oakley, head of UK and European commercial research at Savills, said: “We don’t expect interest rates to begin falling until Q3 next year, but investors can now start to believe that the next move is downwards: this is important for market pricing and activity over the next six months. The removal of one reason not to buy now is important, but buyers’ attention will now focus on rental growth prospects and capex concerns.”

Richard Merryweather, joint head of UK commercial investment at Savills, said the agency’s most recent investor sentiment survey of European and Middle Eastern pan-European buyers “shows positive conditions for those looking to sell in the UK: 80% of respondents want to invest here over the next 12 months, driven by both a recognition of the growth prospects and more realistic pricing than some other countries”.

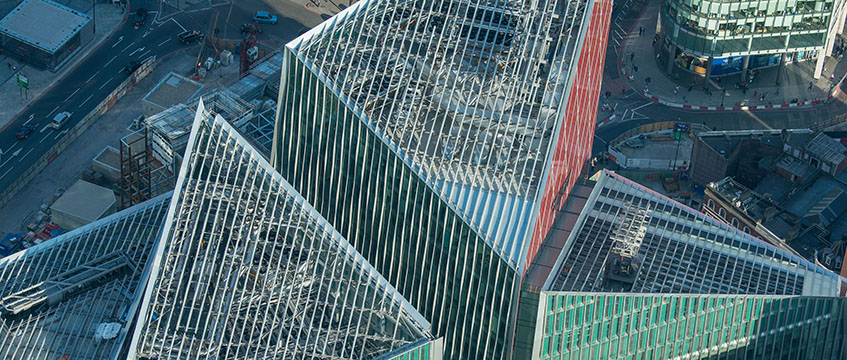

He added: “While logistics remains top of their shopping lists, CBD offices unsurprisingly currently aren’t as favoured, but we expect this to change as it becomes more widely recognised how strong the UK prime office market actually is – signs of which are already starting to come through in central London deal activity.”

To send feedback, e-mail chante.bohitige@eg.co.uk or tweet @bohitige