Co-working company WeWork has begun a preliminary search in Manchester, as it looks to set up its first UK sites outside London.

Co-working company WeWork has begun a preliminary search in Manchester, as it looks to set up its first UK sites outside London.

A move to Manchester by WeWork would see the city further establish its reputation as the UK’s most important regional city for innovation, media and technology.

Plans are at an early stage, but WeWork typically takes multiple sites in each city to give its members options and establish a strong presence.

If WeWork opens in Manchester, it is anticipated that it could look for up to three locations. Spinningfields, St John’s and the Northern Quarter are likely to be prospective areas of focus.

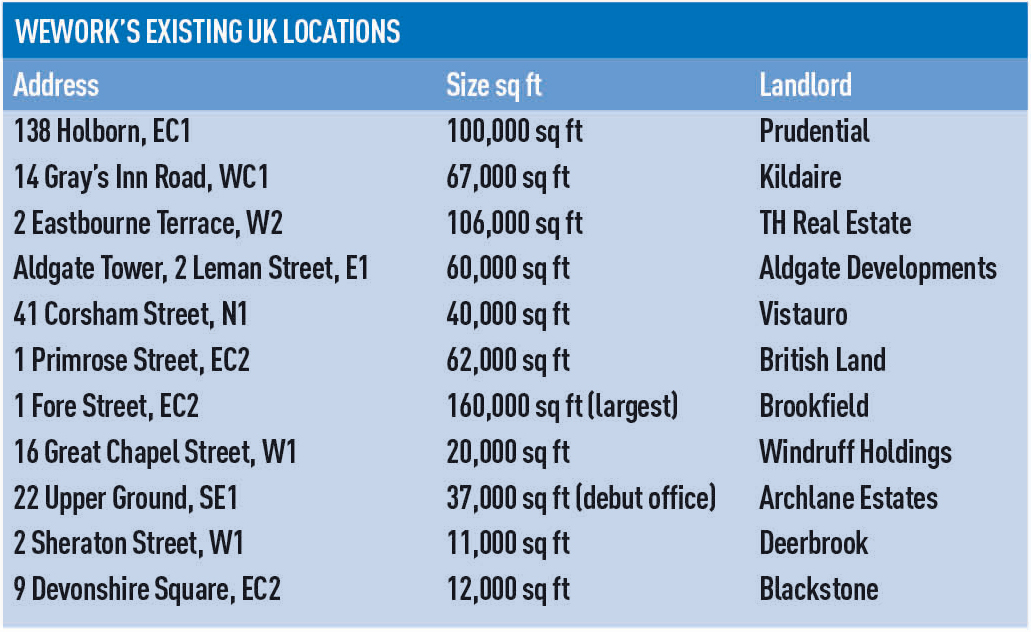

WeWork has 11 locations in London totalling around 700,000 sq ft, which range from 11,000 sq ft to 160,000 sq ft with an average size of around 61,000 sq ft, and it is looking for more (see below).

A WeWork spokesman said: “There is enormous opportunity for WeWork in the UK and we are always exploring ways to add to our community here. Right now, however, we are very focused on our London locations, and the continued expansion here that we have just announced.”

The US firm has 115 locations in 13 countries across four continents. However, other than within its domestic market and Israel, it does not have sites in more than one city in any of those countries.

WeWork’s London ambitions

WeWork is aiming to double its presence in London by the end of next year.

It currently has more than 10,000 members signed up to occupy space in its offices and wants to take this to over 20,000.

It already has a strong presence in the City and east London.

The size of its requirements are flexible. Its smallest location in London in terms of members is in Devonshire Square, EC2, where it occupies 12,000 sq ft and has 200 members, while its largest is at Brookfield’s Moor Place, EC2, where it occupies 160,000 sq ft and 3,000 members are accommodated.

The $16bn company’s property expansion in Europe is driven by head of European real estate Patrick Nelson. This week it announced two new locations that will open next year – GI Partners and Rowan Strategic Asset Management’s 71-90 Aldwych, WC2, where there will be capacity for 1,500 members, and Hackney Council’s 115 Mare Street, E8, which will have potential for more than 800 members.

Manchester’s media and innovation stripes

Manchester has been at the forefront of attracting media occupiers and concepts to the regions and is fast becoming a hub for innovation and small businesses.

Soho House Group – known for its media and tech-focused membership – through its restaurant division, Rollout Restaurants, is to open a Mollie’s at Allied London’s Old Granada Studios (pictured) on Quay Street. Mollie’s is a new motel diner, hotel and shop concept from the group and it has yet to establish its first location.

Robert Wolstenholme, whose company Trilogy Property has teamed up with tech firm Blenheim Chalcot to develop an accelerator space at 101 Princes Street, said: “London is getting very expensive and Manchester is an obvious alternative for young people – it is desirable to live in and has a strong talent pool. Its combined universities, its ‘Cool Britannia’ history and edge also give it a certain zeitgeist.

“For practical development, there are also amazing, beautiful Victorian warehouses which are ideal for interesting conversions.”

A report by Capital Economics earlier this month found that the number of SMEs in the city had increased by 36% since 2010 and they now employ 27,000 people. A further 16,000 jobs are forecast to be created by 2020 in the city, which will see Manchester SMEs contribute £12bn to the economy a year.

• To send feedback e-mail louisa.clarence-smith@estatesgazette.com or tweet @LouisaClarence or @estatesgazette