Eastdil Secured has been arguably the biggest disruptor in the UK and European property markets this decade. Now a share of the loud and proud US real estate investment bank that has stolen considerable market share from its more traditional rivals is up for grabs.

Its parent, mortgage giant Wells Fargo, is considering bringing in third-party equity to reduce its exposure to the business, in part due to the tough regulatory environment for banks and its eagerness to please the regulator. The process is being driven by Eastdil management and it is expected that there will be material progress by the end of the year with a resolution most likely at the start of next year.

Wells has been under the microscope from the Federal Reserve since February due to “widespread consumer abuses” including its staff creating fake accounts in order to hit targets and forcing customers to buy unneeded car insurance.

As a result its $2tn (£1.5tn) of assets are not allowed to grow until the regulator is satisfied the bank has cleaned up its act. It is also seen to have grown rapidly and its systems have become antiquated in relation to the size of its business.

Rules around brokerage and fund management for investment banks are not hard and fast, but it is an area that is increasingly coming under scrutiny from the regulator. Wells may not be being literally forced to sell Eastdil or reduce its exposure, but it is eager to please and any divestment is a move that will likely conjure a brownie point from the Fed.

Let’s stay together

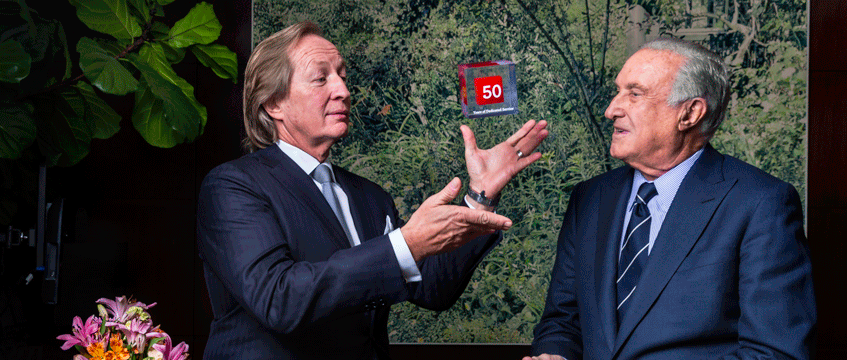

An outright sale of the business, which is run by chief executive Roy March and chairman Ben Lambert, is by no means a certainty with the ownership of Eastdil providing many benefits to its parent, particularly in the US. The market knowledge that Eastdil shares with its parent allows Wells to take a more educated view of the market in its real estate lending activities.

Wells has a far more eclectic product range in the US than in the UK and Europe where it has fewer regulatory approvals and this allows for major synergies meaning that a continued relationship is of major benefit.

In the US, Wells has the ability to help underwrite equity issuances for listed firms for example meaning that there are more dual opportunities for advisory roles alongside each other, with some employees even having Wells and Eastdil logos on different sides of the same business card.

This is not quite as relevant in the UK, Europe and Asia however due to Wells’ smaller product range, although it is still able to flex its muscles with services such as the issuances of bonds. Eastdil has also been looking to expand accordingly, bulking up its offering to the listed sector, notably having recruited Max von Hurter from Lazard in May.

Better apart?

There are, however, headaches that occur at Eastdil because of its Wells ownership. Eastdil’s notorious compensation policy for its top performers allows for big pay days at a time when executive pay is being questioned in the banking sector. That has the potential to cause friction, as does the pressure to adhere to time consuming regulation.

Eastdil’s famously aggressive debt brokerage business, which hammers away to get the best deal for borrowers is not always the most popular with lenders such as Wells that have to offer scant margins as a result. In some senses the company has become a somewhat unhelpfully successful market dynamic for its parent.

Who wants a piece of Eastdil?

Despite these slight aggravations, an overall desire from Wells to maintain a relationship and part ownership of Eastdil, as well as management’s preference to maintain its name above the door as a standalone business would seem to most likely rule out a trade sale to a rival. Most likely is a deal with a small clutch of private equity or pension funds.

The fact that both listed rivals CBRE and JLL are trading well is also a positive indicator that buyers or investors are willing to pay a decent lick for exposure to the world’s best businesses, something that has no doubt influenced the owners of the soon-to-be-listed Cushman & Wakefield. However, an IPO of Eastdil is not being considered.

Even if a third-party investor is a preferred option for the Eastdil management the company’s near unrivalled capital markets and debt advisory expertise and deal-making ability would make it a weighty bolt on to any advisory business and will likely turn heads.

However, any buyer would have to pay a pretty penny near the top of the cycle and many firms are striving towards expanding their recurring income functions through professional services rather than through the lumpy transactional fees such as those Eastdil generates.

Since its entry into the European market in earnest in 2012 Eastdil has been the adviser on the name on the lips of many investors and fellow advisers alike and this reconsideration of its ownership by Wells has done nothing to change that.

Eastdil’s Brexit conundrum

Brexit is another issue that is quickly coming into view for Eastdil with considerations as to where it is most appropriate to have an official headquarters in Europe for a US bank-owned business post the UK’s exit from the EU. It is possible that some functions may be moved to the continent or the make-up of boards amended.

This has a myriad of complications, not least with compensation. Eastdil’s “teamwork makes the dream work” slogan means maintaining one global profit and loss account to help reward cross border collaboration and any threat to this structure would be utmost in the minds of management if any changes were made.

To send feedback, e-mail david.hatcher@egi.co.uk or tweet @hatcherdavid or @estatesgazette