Four key factors are shaping London’s housing scene, according to EGi’s latest London Residential Market Analysis.

Four key factors are shaping London’s housing scene, according to EGi’s latest London Residential Market Analysis.

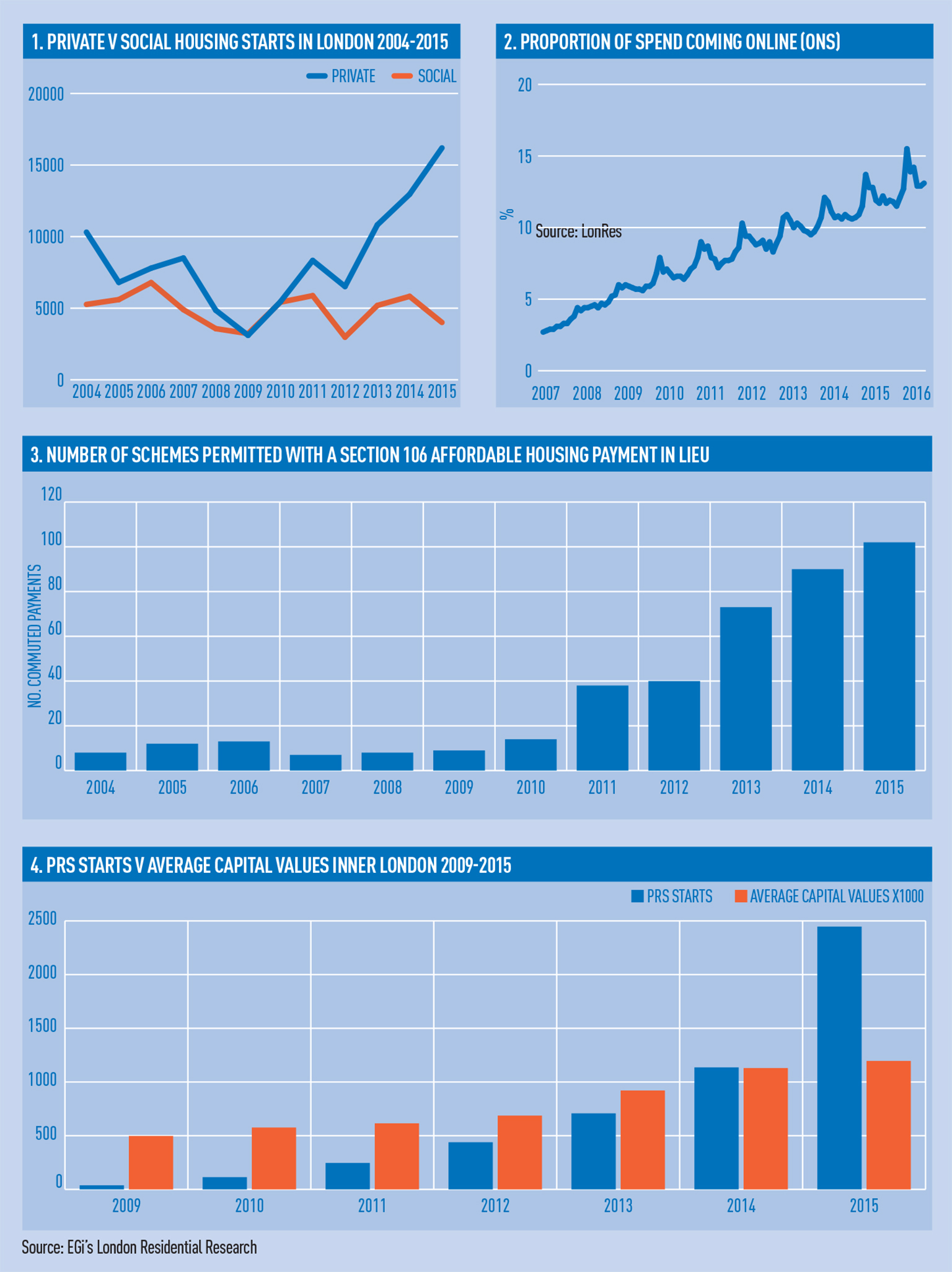

First, there is the increasingly split relationship between private and social housing provision to levels never seen before, resulting in a 31,000-unit shortfall in expected construction starts on social homes (see graph 1).

This shortfall in on-site delivery has been mitigated in part by an increased regularity in section 106 affordable housing payments – but is that enough? Last year, a total of 102 permissions were granted with an obligation to provide funding for affordable homes – the first time this number has broken into three figures (see graph 3).

Within this, permitted development rights schemes are contributing in their own way to the erosion of new-build social housing numbers in the capital. EGi estimates that PDR has resulted in the loss of some £178m in commuted payments in lieu of affordable housing, as well as 2,090 on-site affordable units.

Student accommodation has undergone a transformation from low-grade secondhand stock to purpose-built halls of residence. With this will come a change in expectation, starting with postgraduates, of what rented accommodation could and should be. The report looks at the themes that have driven an increase in construction activity on student spaces in both the inner and outer boroughs.

Finally, institutional interest in the residential sector is increasing. Why? These types of investors would normally cast their eye towards other asset classes to provide the long-term, stable yield they crave. However, circumstances in the retail sector, for example, have meant that these investors are looking elsewhere.

Online spend reached almost 16% of total UK retail spending in November 2015 (see graph 2) and is predicted to climb further, while average lease lengths on new retail deals are shrinking. These factors have created an environment in which the security that was once almost assured with investments into physical retail space becoming much scarcer.

All of this has created a “perfect storm” in which the private rental sector has begun to boom – with a 115% increase in starts on PRS units year-on-year (see graph 4).

Graham Shone is senior analyst in EGi’s London Residential Research team