From industrial to retail, prime central London to regional residential, and even a punt on glamping pods – five very different investors tell Julia Cahill where they have found opportunity this year.

David Bailey, director, PNT Property

Before setting up PNT Property in 2011, David Bailey spent more than a decade as a chartered landscape architect.

He designed and delivered public and private schemes from town-centre regeneration projects to planning applications for schemes as large as Battersea Power Station. He was also part of the design and delivery team for the 2012 London Olympics stadium.

Now he’s delivering his own projects – albeit on a smaller scale – through his residential property company.

His main purchase this year was a 5,000 sq ft site in Chelmsford, Essex, where he is close to completing two detached homes. The plot at the end of a garden was bought off-market subject to planning in June after Bailey spotted it during one of his regular scouts for opportunities.

“The owner saw it as his pension pot and was willing to work with us in a longer timescale to allow us to work on the planning,” Bailey says.

He initially secured planning consent for two semi-detached homes before improving this to two three-bedroom detached homes to enhance the GDV.

The build is now well under way and should be complete before or soon after Christmas.

Banks were happy to lend on this kind of project, he says.

“They’re not keen to lend on big trophy assets. These homes are aimed at people upgrading from a terrace house or a flat. The banks don’t see that demand falling away at the moment.”

The site cost £290,000 and the build cost is £337,000, excluding finance costs. Bailey expects the homes to sell for around £435,000 each.

“My magic number is 25% profit on GDV. It’s difficult to find but that number needs to be there because of the market uncertainty.

“If things straighten out after Brexit, then great. But if there’s a wobble, you really need that margin built in,” Bailey says.

He may sell the homes off-plan to reduce his finance costs through an early exit. Bailey’s other projects at the moment are long-term holds: he’s converting one house into three dwellings and another house into five flats. Once let, these will add to PNT’s existing income-producing portfolio, which includes two HMOs.

Rahim Virani, managing director, Cygnet Properties & Leisure

Cygnet Properties & Leisure is a family run business which owns £87m of property, predominantly offices and industrial, but also including retail.

“Our best buy of the past 12 months was the Langley Mill Business Park in Salford, Greater Manchester,” says Virani.

The property comprises 225,000 sq ft of warehousing on a 7.5-acre site.

“This was an off-market private treaty deal that we completed in June for £5.1m, which reflected a net initial yield of 9%. The vendor was keen to obtain a quick sale, hence we were able to negotiate the price down from the £6m asking figure and due to the very short WAULT (weighted average unexpired lease term), the deal required a cash purchaser,” says Virani.

Cygnet keeps its gearing low and typically buys with cash from its own reserves before seeking finance further down the line.

“The reason this was a good purchase was that there were immediate asset management opportunities to enhance the income by signing up with tenants whose leases had expired and were paying well below market rent,” Virani explains.

“There is also unutilised land on the site where new units can be developed. There is strong demand for industrial and storage space, (it is) so close to Manchester city centre, and rents are expected to rise in the short to medium term.”

Looking further ahead, Virani says the value is underpinned as a residential development as there are new starter homes being built by a well-known housebuilder less than half a mile away.

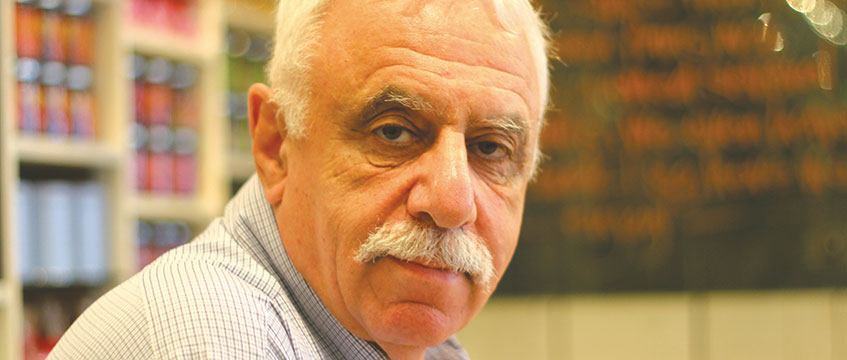

David Pearl, chairman and chief executive of Structadene Group

Veteran private investor David Pearl’s main company – Structadene Group – owns net assets of £450m. He has been a stalwart of the commercial auction market for decades.

Speaking to EG in 2016, he estimated that around 120 of his properties, worth £60m, had come through the auction room. But now Pearl says he’s put a break on buying at auction because he is cautious about commercial investment outside central London.

“Up until a year ago, we were buying property all over the country,” he says.

“Now we’re focusing on our favourite patch of Fitzrovia, SW1, where we have considerable holdings of typical mixed-use buildings with commercial on the ground floor and either offices or residential above.

“We are also buying in Covent Garden and Holborn, (both WC1).” He says the deals tend to be private treaty.

“If you go through the auction catalogues, there is nothing in central London at the moment.

“We’ve stopped buying outside London because it is too high risk. I’m sure you can get good returns from prime covenants. We might get a 3% return in Fitzrovia. You could get 10% on a high street shop let to a multiple in the regions but then a CVA comes along.

“No one knows how bad it is really going to get [on the high street]. Even Marks & Spencer is closing stores. That makes me shudder.”

Kishor Ruparelia

Wembley-based private investor Kishor Ruparelia has built much of his fortune from buying and selling auction lots over more than 30 years. He owns around £15m of commercial and residential property in his own right and also buys and manages properties on behalf of his business partners.

In this market, Ruparelia is sticking to what he knows. He looks for added-value angles, including possible redevelopment, properties that are under-rented, or change of use. He buys parades of shops to break up and trade on, often selling the shops to existing tenants.

He’s focusing on opportunities mainly outside London and on smaller lot sizes. “There’s more demand for smaller lots. I know I can turn them again,” he says. “The more expensive lots are struggling.”

He is also capitalising on the fact there are more deals to be done post-auction in the current climate.

Deals he has been particularly pleased with this year include two shops with uppers bought at May’s Allsop commercial sale. He picked up a shop in Tring, Hertfordshire, let to an independent nail bar for £241,000, a 5.39% yield, and a shop let to an independent dry cleaners in Woburn Sands, Buckinghamshire, for £234,000, a 5.56% yield.

Ruparelia says both properties were on low rents and he has improved the income by negotiating a new 10-year lease on one and is in the process of doing the same on the other.

Another “best buy” this year was a fish and chip restaurant on the A64 close to Scarborough, North Yorkshire, which was offered by Barnett Ross in May with a reserve below £490,000. Ruparelia paid £460,000 for the restaurant, let to chain Deep Blue Restaurants on a 15-year lease from November 2009 and produces £40,000 per annum – an 8.7% yield.

Michelle Benford

Michelle Benford is an East Midlands-based investor with around 10 properties in her portfolio. She is a regular auction buyer.

In September, she bought one of the most unusual lots offered to date by SDL Auctions Graham Penny: two octagonal buildings, measuring approximately 14ft across, which were originally used for hanging game after shoots on the estate of Rangemore Hall near Burton-on-Trent.

She met the £50,000 guide price and hopes to turn the two game houses into glamping pods, subject to obtaining planning permission.

“I knew that this lot came with many challenges, as it is a Grade II listed property, but I am excited about the prospect of bringing these old buildings back to life,” says Benford.

“My main reason for buying The Games Houses was the location – it has fantastic views over the Rangemore estate, with easy access to St George’s Park, Barton Marina and Lichfield.

“I am intending to keep the outside of the houses the same but modernise the interiors. Subject to planning, the intention is for the two ‘pods’ to be able to sleep a total of eight people. And if planners share my vision, I am hoping to develop a barbecue hut, hot tub area and annexe with bathroom facilities,” she says.

To send feedback, e-mail julia.cahill@egi.co.uk or tweet @EGJuliaC or @estatesgazette

■ This article appears in the November edition of EG’s Property Auction Buyers’ Guide, out on 24 November