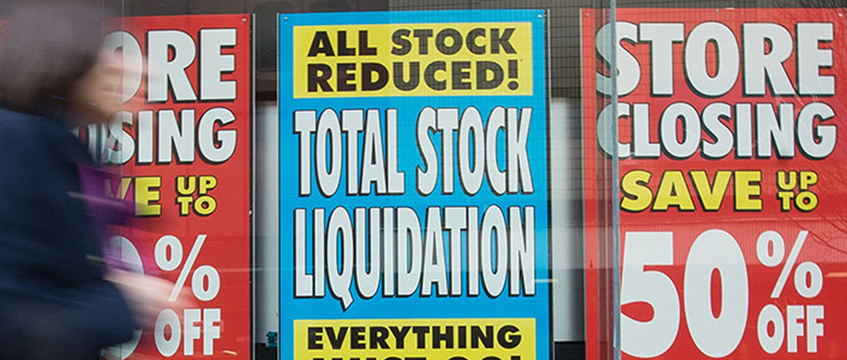

More than 50 retailers spoke with one voice this week, pleading for governmental help as the downturn on the high street bites – but questions remain over whether they asked for quite the right things.

A no-deal exit from the European Union looks increasingly likely under new prime minister Boris Johnson, said bosses from a long list of big-name retail companies in a letter to chancellor Sajid Javid. Such an outcome would place even more strain on businesses that are already struggling to keep up with changes in the way people shop.

The letter, organised by the British Retail Consortium, zeroed in on the inefficiencies of business rates, the tax on commercial properties, which the retail bosses described as “outdated”, “broken” and “hindering our plans for investment, holding back productivity growth and detrimentally impacting communities up and down the country”.

“The rate has risen by 50% since business rates’ inception in the 1990s, and 20% in the last decade alone,” the letter added.

Rates have long been a bugbear for retailers, but the issue has gained more attention as troubles on the high street mount. The BRC-led letter came as the trade body published figures that showed the vacancy rate on UK high streets had risen to 10.3% as of late July, its highest level since the start of 2015. With Johnson promising a new package of measures to boost the economy, retailers are hopeful that they may finally receive some much-needed support.

Four steps

The BRC and retailers behind the letter asked for four steps to be taken. First, a freeze in the rate multiplier, the figure by which the rateable value of a property is multiplied by to calculate business rates. Second, a fix for the transitional relief system that sees businesses in some regions pay higher rates to help finance staggered rate rises in London and the South East.

Next, the companies called for rates relief for businesses that face higher bills because of improvements they have made to their properties. And finally, they encouraged Javid to ensure there are full resources for the Valuation Office Agency, which tackles appeals over rates and, according to the BRC, has a backlog of thousands to work through.

They are all reasonable requests, says John Webber, a former VOA employee who now heads the rates division at Colliers International. But even if they are met, he adds, the effect may be less than hoped.

At just over 50p for a standard business, the rates multiplier is already too high, Webber says.

“I don’t think a freeze on the multiplier is going to save one shop, quite honestly,” he adds. “There needs to be a rebasing of that multiplier. Come 2021, that multiplier is going to be closer to 60%. Freezing it right now isn’t going to make a blind bit of difference.”

When it comes to the transitional relief system, Webber says: “the damage has been done”, although scrapping downwards transition, under which companies that should be paying lower rates after 2017 revaluations have seen only limited declines, could save shops and jobs in areas such as the Midlands and the North.

An improvement relief would be “tinkering around the edges”, according to Webber, while his response to a call for better resources at the VOA is: “Best of luck with that.”

Flawed tax system

Revo chief executive Edward Cooke says the organisation is supportive of the BRC and its call to address the problems with rates, but he adds that the proposals in the letter are “more about the administration of what is a flawed tax system”.

“Where we would go one step further is calling for government to seriously consider the introduction of some form of significant digital sales tax that reflects the fact that this is the way that consumers are now shopping and will continue to shop in the future,” Cooke says. “That would allow them to make a radical reduction in the business rate multiplier… for all businesses.”

Cooke calls for “a big debate involving chief execs of retail companies and property companies, and the chancellor and other senior ministers within other departments”.

Does he believe that government is ready to open that dialogue?

“I think they recognise the problem,” he says. “The big question is: are they prepared to do anything about it? Thus far what they have done has been tinkering, not radical. Do I think that this group [of ministers] might be more radical? Recent announcements suggest that the government is looking at ways to invest in certain parts of our economy to shore it up as a result of the inevitable economic impact of leaving the European Union. Hopefully out sector and business rates specifically will be next on the list of announcements.

“We live in hope.”

To send feedback, e-mail tim.burke@egi.co.uk or tweet @_tim_burke or @estatesgazette