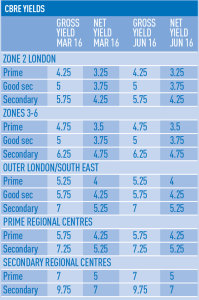

Amid bad news around stamp duty exemption and caution around the EU referendum, yields have remained flat for private rented sector investments.

According to CBRE’s residential yields snapshot, UK institutions remained active with M&G, LaSalle and Hermes all buying schemes in Q2 in London, Birmingham and Manchester.

Executive director of valuation and advisory services Jason Hardman said general sentiment in the sector was good and pricing was stable, with the deals done supporting the yields that have been previously recorded. “There is no let-up of funds in the sector and appetite is still very much there. A number of funds are still recruiting acquisition teams, and people are raising further money,” he said.

CBRE said the referendum was having little or no effect on investment, with the supply and demand imbalance outweighing concerns.

According to the agent, the outlook remains positive, with a trend towards forward-funding deals set to mitigate the SDLT increase. “We have a few obstacles from a planning policy perspective,” said Hardman. “But the sector is getting itself together via the BPF and others to say this is what PRS means.”

• To send feedback, e-mail alex.peace@estategzette.com or tweet @egalexpeace or @estatesgazette