Though recent comments from Prologis chief executive Hamid Moghadam point to a gradual stabilisation of the industrial property market, small businesses face problems in securing adequate warehousing, and this lack of flexibility has appeared as an opportunity to an enterprising few.

Several companies have emerged offering to provide warehousing-on-demand, by leveraging cloud computing to provide quick and flexible service solutions. Specifically marketed at fast-growing businesses and SMEs with dynamic requirements, these companies leverage empty space in existing warehouses and combine it with integrations to popular order management and inventory management tools as a bundle.

The role model for these operations is Amazon, which has gained thousands of customers through its Fulfilment by Amazon (FBA) programme. The company has exploited its position as the dominant e-commerce sales channel to attract SMEs looking to outsource their warehousing and fulfilment operations. By combining its physical assets with well-versed integrations to leading inventory and order management platforms, the company has been able to take on a significant amount of business, and is now expanding further into logistics operations.

In addition to Amazon, companies such as Shipwire (owned by Ingram Micro), the UK start-up Stowga and even FedEx have jumped on the bandwagon. The great enabler for such solutions is Software as a Service (SaaS), a variant of cloud computing that enables companies to access software remotely through an internet connection rather than by installing the relevant systems locally.

This also means that it is much easier to connect distinct software functions together; for instance, to connect a cloud-based warehouse management system (WMS) to a cloud-based transportation management system (TMS), the integration needs to be achieved only once, and can be done remotely. Doing so with locally installed software requires the manual integration of operations throughout a company’s entire network, which is expensive and time-consuming.

Many of these companies utilise their own warehousing space, and are therefore no different in some ways from conventional 3PLs. Others, however, such as Anchanto and Flexe, pitch their services as technology platforms, relying on partners or third parties to provide the actual warehousing space.

The flexibility provided by software means that companies now have the option to fulfil orders from a single “virtual warehouse”, while their physical inventory is spread out over several facilities. Operations such as this, once impossible, will proliferate, and the implications for industrial warehousing are a world in which space is used far more efficiently.

Alex Le Roy, tech analyst, Transport Intelligence

IN THE NEWS

McLaren drives into Sheffield…

McLaren Automotive is to open a £50m plant on the campus of the University of Sheffield’s advanced manufacturing research centre. The Surrey-based supercar maker and sister company to the Formula One team is setting up a composites technology centre that will develop super-strong carbon fibres to replace metal chassis components

…while LGM drives Aston

Legal & General Investment Management Real Assets is partnering with Aston Martin to support the development of the British luxury car maker’s new manufacturing facility in south Wales.

Protect industrial land in London

London’s industrial land needs to be protected in order to keep the city moving, a new report by SEGRO and London planner Turley has warned.

Whistl for shed letting

Harworth Group has completed a 225,000 sq ft letting to postal operator Whistl at its Logistics North development in Bolton, Greater Manchester. Whistl took 224,938 sq ft at Logistics 225 on a 10-year lease at £6 per sq ft.

WATCH OUT FOR

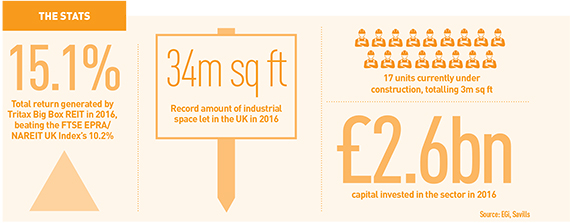

Take-up slowdown? After a record year for take-up in 2016, industry experts have expressed more caution about this year’s performance. Jon Sleeman, director, industrial and logistics research at JLL, said: “We are tracking a large number of active requirements for big-box space and, therefore, expect continuing robust demand this year, although at a somewhat lower level than 2016, owing to a slowdown in the UK economy.

Driverless delivery Last year Uber bought Silicon Valley tech firm Otto, which has been trialling its autonomous delivery software – the first delivery was a truck full of Budweiser. Driverless delivery vehicles might not be appearing on the roads in the near future, but they are on their way and some changes to logistics requirements at least are inevitable.

ACRE Capital Real Estate Former CBRE shed duo Ed Gamble and James Leach have teamed up with Mark Wilson from JLL to launch a new firm, ACRE Capital Real Estate. Simon Verrall, who worked with Wilson in the JLL capital markets team, has also joined, along with Holly Richardson, formerly of CBRE.

Online demand E-commerce now accounts for one-third of the UK’s retail market and with returns running at 20-40%, demand for last mile logistics space looks set to continue.

EG INDUSTRIAL WEEK

• National agent tightens its grip on industrial agent league

• Has cloud computing turned industrial real estate into a liquid asset?

• Can industrial and residential ever be bedfellows?

Can industrial and logistics space be successfully incorporated into mixed-use development?