Agents pick most significant deals to end of October

Rolls-Royce Technology and Logistics Centre, Oldlands

Type of deal Logistics development

Developer Bericote

Occupier Rolls-Royce Motor Cars

Funder Tritax Big Box REIT

Size 323,000 sq ft

Value Undisclosed

Chosen by James Brounger, south central regional MD, CBRE

Given its scale, the profile of the parties involved and its complexity, this must rank as one of the most important logistics deals ever along the South Coast.

Having shortlisted sites to provide a major technology and logistics facility close to its manufacturing centre at Goodwood, Rolls-Royce chose Bericote as developer and Oldlands Farm as the location for its new facility.

The deal was announced by Rolls-Royce Motor Cars chief executive Torsten Muller-Otvos in September, and the new site is scheduled to be operational in early 2016. It will consolidate various functions for Rolls-Royce and it is understood some 200 people will be employed at the facility.

It is expected to boost the local economy in and around Bognor Regis and act as a catalyst for further investment.

In a further development, forward-funding for the new centre has been confirmed with the Tritax Big Box REIT.

The Pavilion, Botleigh Grange, Hedge End, Southampton

Type of deal Leasing

Landlord Helical Bar & City Estates

Tenant Trethowans Solicitors

Size 23,560 sq ft

Terms £16.50 per sq ft

Chosen by Duane Walker, partner, Primmer Olds Chartered Surveyors

My choice is the recent letting of The Pavilion, a prime office building situated on the Botleigh Grange Business Park. This

is an important letting for the region because the building has been vacant since its construction and practical completion

in 2007.

The building was subsequently sold by receivers and took several years to be let. Local occupier Trethowans Solicitors has taken an overriding lease.

This letting, in my view, underpins the significant shift in occupier demand that has taken place in the past 12 months and the reduction in prime grade A space within the region.

The building offered a high specification, parking and, at £16.50 per sq ft, represented a significant discount to the pre-recession peak level being quoted at £21 per sq ft. With the investment now for sale, I can see good potential for rental growth in the future for a new owner.

Reading Gateway

Type of deal Development land sale

Vendor Private investors

Purchaser Kier Property and Investec

Size 20.5 acres

Price £29m

Chosen by Philip Hunter, director, Lambert Smith Hampton

I have chosen the sale of Reading Gateway as my top deal so far in 2014. This prime development site, situated next to junction 11 of the M4, has lain dormant since the previous owners purchased it from Hewlett Packard in 2006.

Kier and Investec won an intense bidding process, involving a select group of major investors and developers, in order to secure the site on a completely unconditional basis.

The price achieved is a clear demonstration of the increasing business confidence and economic growth being experienced in the region, boosted by huge investment in the local infrastructure, including the upgrade of the railway station, Crossrail and the direct rail link to Heathrow Airport.

The new owners will capitalise on the pent-up demand, driven by a severe lack of supply across most sectors. They will now progress very quickly with development of the site into a mixed-use scheme, where the end value is likely to be approximately £75m.

Council to approve Unite digs

Unite received the go-ahead for a £42m student development in Portsmouth’s Greetham Street with a city council resolution to approve its 836-bed Cooley Architects-designed block.

Market gets makeover

A £100m mixed-use scheme – comprising homes, student accommodation and offices – in Brighton was approved. Cathedral Group’s and McLaren Property’s scheme will transform a derelict municipal market building.

Green light for Chilmington

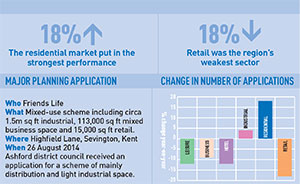

The local authority in Ashford, Kent, granted outline consent for Chilmington Green, an urban extension to be developed by a consortium of housebuilders over the next 15 to 20 years.

Region’s economy strengthens

Investment in the region’s offices hit £619m in Q3, 37% above the five-year average, according to Knight Frank. Meanwhile, nearly 1m sq ft of office space, 17% of total demand, was under offer, according to Strutt & Parker.

Healthy future in Watford

Part detailed and part outline approval for a £260m health campus in Watford gave Kier Property, Watford borough council and West Herts NHS Trust a clean bill of health for their 65-acre site.

Southampton in office crunch

Southampton in office crunch

JLL’s South Coast metropole report highlighted a severe shortage of office stock in Southampton – exacerbated, it says, by both existing premises and development land being lost to alternative uses.

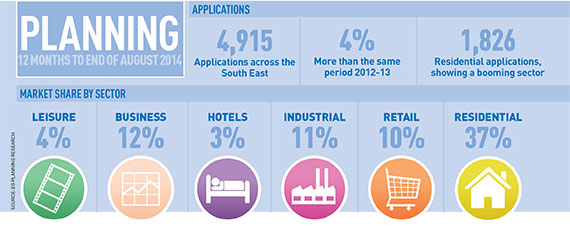

EG gauges the trials and tribulations of the South East property market